CDSPI Legal Expense Insurance

Added support, when you need it most. Included with CDSPI Malpractice Insurance.*

Navigating Canada’s regulatory and legal system can be complex and time-consuming. Legal costs can also add significant financial strain. To help mitigate the risk of unexpected legal expenses, eligible dentists insured with CDSPI Malpractice Insurance will automatically have access to Legal Expense Insurance—at no additional cost. No sign-up or registration is required.

What is Legal Expense Insurance?

Legal Expense Insurance (LEI) is a type of coverage that helps pay for legal services when you face certain legal issues. It gives you access to experienced lawyers and covers eligible legal costs up to a pre-determined limit.

What's Covered

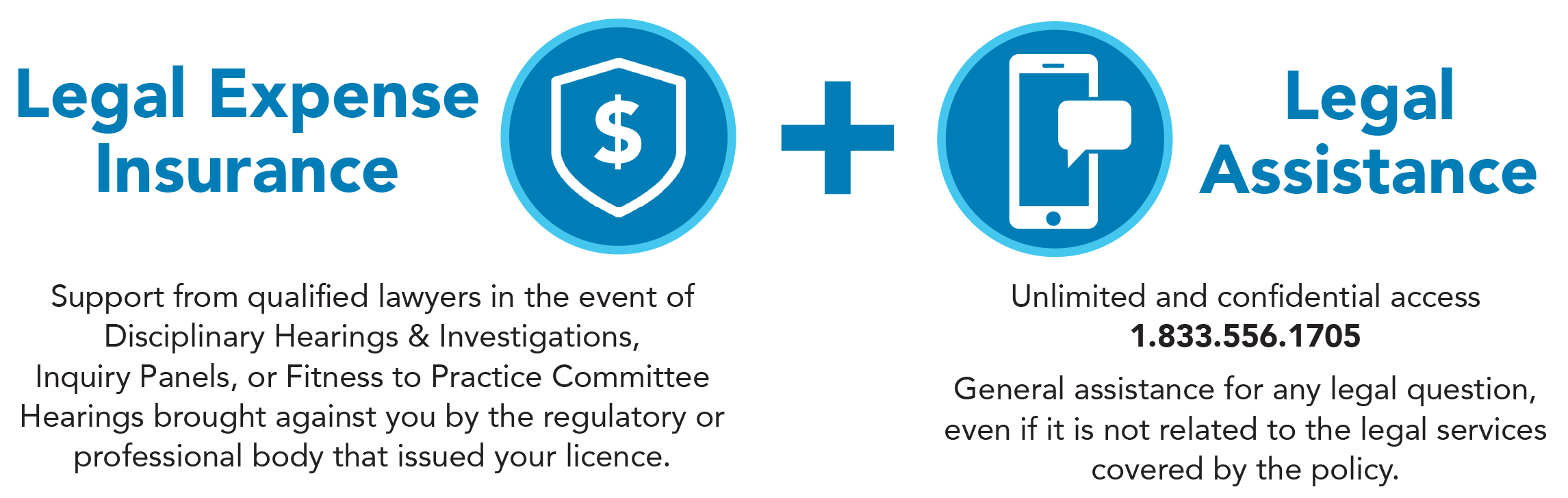

The CDSPI LEI policy is specifically designed for practising dentists who may be involved in Disciplinary Hearings & Investigations, Inquiry Panels, or Fitness to Practice Committee Hearings brought against you by the regulatory or professional body that issued your licence.

It also includes unlimited access to a no-cost Legal Helpline, which offers general assistance for any legal question—even if it’s not covered under the policy. Be sure to read your policy carefully to understand the full scope of your coverage, including any limits or exclusions.

Disciplinary Hearings, Investigations, Inquiry Panels, and Fitness to Practice Committee Hearings

- Up to $20,000 per occurrence and $60,000 aggregate per annual policy term

- $1,000 deductible

LEGAL EXPENSE HELPLINE

- Unlimited and confidential access to the Legal Assistance Helpline at 1.833.556.1705

- General assistance for any legal question, even if it is not related to the legal services covered by the policy

While your Malpractice Insurance, provided by Zurich Insurance Company Ltd (Canadian Branch), covers professional liability claims, your Legal Expense Insurance, underwritten by HDI Global Specialty SE and arranged through ARAG, covers disciplinary hearings and investigations, inquiry panel hearings, and fitness to practice committee hearings, and provides unlimited access to a lawyer via the Legal Helpline.

Eligibility

To be eligible for Legal Expense Insurance, you must be a dentist with:

- Practising Status coverage under CDSPI Malpractice insurance; and

- Not be covered under the BCDA member-only Legal Expense Insurance Plan

If you are eligible, you are automatically covered. There’s no need to sign up or pay an additional premium.

The Claims Journey

THE LEGAL HELPLINE

As soon as you become aware that you may be the subject of a disciplinary hearing, inquiry panel investigation or a fitness to practice committee hearing, contact the Legal Assistance Helpline at 1.833.556.1705.

When calling the helpline, you will first speak with an intake agent who will ask for:

- Your name, province, phone number and CDSPI Account Number

- Your policy number which is 8002645

- The nature of your legal inquiry

- Consent for a lawyer to leave a voicemail if needed

If a lawyer is not immediately available, the intake agent will request three preferred 2-hour time slots for a callback. You will then receive a Case Number for reference.

A lawyer will return the call within 24-72 hours, making up to three attempts during the provided time slots. If voicemail consent is given, a message will be left if consent is given. If all attempts are missed, you can call the helpline with their Case Number to reopen their request.

CLIENT ASSIGNMENT AND FURTHER INFORMATION GATHERING

An ARAG Claims Analyst will be assigned and will contact you by phone and email within 24 to 48 hours after your initial discussion with the Helpline Lawyer.

- The Claims Analyst may request further information and/or documentation be provided and may also schedule a phone meeting to gather details that will assist the insurer in making a final claim decision.

FINAL COVERAGE DECISION

You will be notified if there is coverage for your claim.

- The insurer will make a final coverage decision, and you will be notified both by phone and email explaining the basis for the coverage decision.

- In the event the claim is declined, you can still use the Legal Assistance Helpline to receive general legal assistance to help with your specific legal event.

A LAWYER IS ASSIGNED

- For most insured events, you will deal directly with an assigned lawyer until the issue is resolved.

- The assigned ARAG Claims Analyst will also remain involved to answer any questions you may have, and to ensure the claim moves forward in an efficient and timely manner.

REMEMBER

- You must notify ARAG within 120 days after the date you first become aware that a Disciplinary Hearing & Investigation, Inquiry Panel, or Fitness to Practice Committee Hearing has been brought against you.

- Only legal expenses that have received prior written approval from ARAG will be reimbursed.

- For full coverage details, deductibles, exclusions, and policy limits please refer to your Legal Expense Insurance policy documents.

FAQs

Claim Scenario

DR. LING'S SCENARIO | DISCIPLINARY HEARINGS & INVESTIGATIONS

- Ling is registered with his province’s dental college as a general dentist. One day he was notified that the dental college had received several complaints regarding his billing practices and an Inquiry Panel was being convened. Concerns were also raised related to record-keeping, informed consent protocols, diagnosis and treatment planning, and advertising and promotional activities.

- Ling was shocked. He strongly believed his actions were the same as any other business savvy dentist and he felt he had done nothing wrong.

- Ling called the ARAG Legal Helpline right away. His call was escalated to the ARAG Claims Team. After further information gathering by the assigned Claims Analyst and approval of the claim by the insurer, ARAG assigned a lawyer with expertise in disciplinary hearings to handle his claim.

- During the investigation, the lawyer assisted Dr. Ling in responding to the Inquiry Committee. Unfortunately, the Inquiry Committee directed that a notice of disciplinary hearing be issued against Dr. Ling and a disciplinary hearing was scheduled.

- After consultation with his lawyer, Dr. Ling made admissions and proposed a resolution under the province’s health legislation. The Inquiry Committee approved Dr. Ling’s proposal and ordered him to complete an education program.

Dr. Ling was thankful he had Legal Expense Insurance coverage as it covered up to $20,000 of his legal fees and he avoided having his licence to practice suspended.

Sample Legal Helpline Questions

- I am thinking of terminating an employee, and I want to make sure I do it in a manner that complies with the law. What steps should I follow?

- I recently separated from my spouse, and I want to take my kids on vacation in Florida. What legal steps should I take to avoid trouble at the border and with my ex?

- I have a supplier that delivered a damaged dental mold. They refuse to replace it. What are my rights?

- I received a letter from the Canada Revenue Agency (CRA) saying my practice is being audited. How should I reply and what are my rights during an audit?

- Patrons at the bar next to my practice are frequently smoking in front of my building and I’ve received complaints from my patients. I’ve spoken to the bar manager and written to their head office, with no response. What are my legal options?

About ARAG Legal Solutions Inc.

ARAG Legal Solutions Inc. (ARAG) is the Canadian market leader and managing general agent specializing exclusively in Legal Expense Insurance. Working with broker, insurer, and mutual partners, ARAG creates access to justice solutions for Canadian families, small business owners, strata councils / condominium boards, residential landlords, and more. Its policies are underwritten by HDI Global Specialty SE (HDI). Both Standard and Poor’s and A.M. Best rated HDI as A+ (Outlook Stable).

ARAG is part of the ARAG Group, the largest family-owned enterprise in the German insurance industry. Active in 20 countries, including the U.S. and Australia, ARAG is also represented by international branches, subsidiaries, and shareholdings in numerous international markets in which it holds a leading position as a provider of legal insurance and legal services. With over 5,000 employees, the Group generates revenue and premium income totalling more than €2.8 billion.

Contact ARAG

If you have a legal question or want to make a claim, please contact the Legal Helpline immediately at 1.833.556.1705.

Get Support from Our Member Assistance Program

When you're involved in legal issues, it's natural to feel like things are happening outside of your control. Stress, uncertainty, and the weight of decision-making can take a toll on your well-being. That’s where our Members' Assistance Program (MAP) comes in.

MAP offers free, confidential counseling, financial guidance, and support resources to help you manage the emotional and practical challenges that often accompany legal matters. Whether you need someone to talk to, advice on handling stress, or strategies to navigate difficult situations, MAP is here for you.

Confidentiality – MAP Services are fully confidential within the limits of the law. No one, including CDSPI or your Provincial Dental Association (PDA), will ever know that you, your spouse or your child used the services unless you tell them.

Take care of yourself while you take care of your legal concerns.

*Eligibility conditions apply. Coverage under the CDSPI Excess Malpractice program does not qualify for Legal Expense Insurance.

Legal Expense Insurance is arranged for by ARAG Legal Solutions Inc. (ARAG) on behalf of CDSPI. ARAG Legal Solutions Inc. policies are underwritten by HDI Global Specialty SE.

CDSPI Malpractice Insurance is underwritten by Zurich Insurance Company Ltd (Canadian Branch). Full coverage details, terms and conditions (including deductibles, policy limits, restrictions and exclusions) are set out in the insurance documents and policy wordings governing each plan.

MAP is sponsored by CDSPI and provided by TELUS Health.