Disability Insurance for Dentists

Protect your lifestyle and your income with DisabilityGuard™.

Just about everything you plan on accomplishing in the future is based on the expectation that you will continue to earn an income. That income is what will allow you to support yourself, your family and achieve your goals. That’s where disability insurance for dentists comes in and why DisabilityGuard Insurance can play a role in maintaining your lifestyle. If you suffer a disabling illness or injury, the plan provides you with a monthly income benefit of up to $25,000 to help replace your lost income.

DisabilityGuard Plan Features

Own Occupation

The most comprehensive definition of own occupation coverage available which protects your ability to work in dentistry—plus it's included at no extra cost.

What this means is you can still receive disability benefits even if you are able to earn income from a new occupation. An example would be a dentist, who due to Parkinson's disease can no longer practice clinical dentistry, but could earn an income doing something new and unrelated to their regular/own occupation, such as teaching dentistry. Without the own occupation definition, benefits would likely be reduced or even cut-off completely.

Read the plansheet for complete plan details as well as all available options.

FAQs

An elimination period is a waiting period. It is the number of days you must remain continuously disabled before your monthly benefits begin.

CDSPI offers you a choice of elimination periods. You may choose when your benefits will begin, depending on your anticipated financial needs.

When you get a quote using our online calculator, try different elimination periods to see how it affects your premium. CDSPI offers a choice of 30, 60, 90 or even 120 days. The longer the elimination period, the lower your premium. When making your choice, consider the amount of short-term savings you will have on hand, and how long you could manage financially without being able to work.

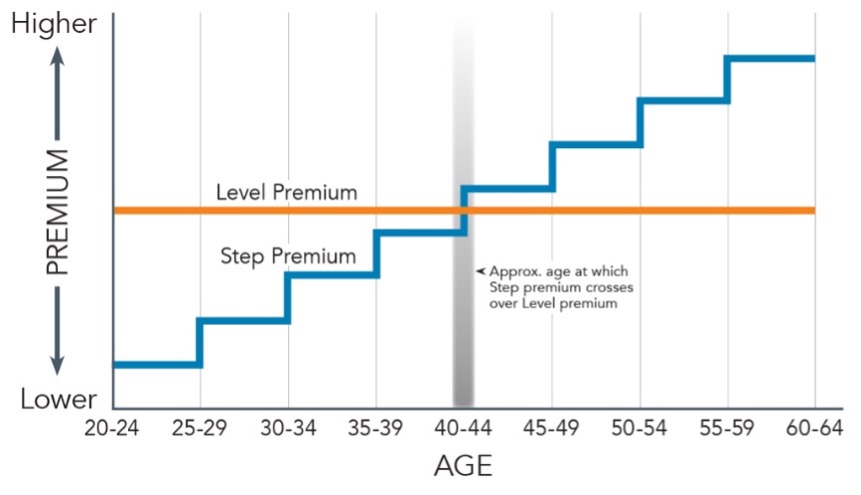

DisabilityGuard offers a choice of step or level premium rates.

Step rates change according to your 5-year age band (under 30, 30-34, 35-39, 40-44, 45-49, 50-54, 55-59, 60-64, 65-69) at the time of your plan renewal. It’s something to consider if you’d like to start out by paying a lower premium and have the premium increase as your age increases – which is also when your income is also more likely to increase.

Level premiums rates mean that your premium stays the same until the January after you turn 65, when your premiums will change to step rates for ages 65-69 and 70-74. While the premium for the level option is initially higher, you will enjoy the stability and consistency of a premium that won’t increase with your age. With this option you typically pay less over the lifetime of the policy.

If you have step premiums and would like to convert them to level, simply contact us.

Whichever option you choose, your premiums are guaranteed.

The first step is to use the Income Ratio Guide to see how much coverage is recommended based on your annual income. If you have the Future Insurance Guarantee (FIG), you can increase annually within 60 days of your birthday without any medical underwriting by completing this form. Outside of that, you can increase at any time with medical underwriting by completing a new application.

This option can help protect your future earnings as your income grows. Each year within 60 days of your birthday, if you are under age 55 and not currently on disability claim, you can give yourself a present and increase your disability coverage without any medical underwriting by completing this form.

The first time you exercise the FIG option, you can do an increase of 50% of the policy. Each subsequent year, you can apply for an increase of 25% of the original policy. Financial documentation will be required to make sure you qualify for the limits under the Income Ratio Guide, but you will not be required to provide financial documentation at time of your claim for Total Disability. You will, however, need to provide financial documentation for a Residual Disability claim.

In the case of both Total Disability and Residual Disability before age 65, your premiums are waived once you’ve satisfied the Elimination Period. In addition to the premiums being waived for as long as your Total/Residual Disability continues, we will also refund the premiums that you paid during the Elimination Period.

The Residual Disability Benefit provides pro-rated benefits when a partial disability limits your ability to work, resulting in a loss of income of at least 20%.

If your disability is partial and results in more than a 20% loss of income, you will receive at least 50% of your maximum monthly income benefit for your first six monthly disability payments. Benefit payments after the end of that six-month period will be calculated based on your actual income loss.

Another CDSPI advantage is that there is no co-ordination of benefits for either Total/Residual Disability. This means that no other policies are taken into consideration when determining your benefits, unless your DisabilityGuard plan was issued based on our understanding that your other Insurance was to be cancelled immediately following the Effective Date of your DisabilityGuard coverage. If the other insurance is not cancelled, the benefit amount that would otherwise be payable will be reduced by the amount payable to you under the Other Insurance. There are also no financials required to file a Total Disability claim, only for a Residual Disability claim.

If you purchase this option and are disabled for a continuous period of 12 months, your benefit will then be adjusted according to the Consumer Price Index, up to a maximum of 8%. This allows you to protect yourself against inflation in the event of a lengthy disability, because you cannot increase coverage while on claim.

CDSPI offers the option to put your DisabilityGuard on hold if you are pursing post graduate studies, doing a residency or on maternity/paternity/parental leave or sabbatical. While putting it on hold means you don’t need to pay your premium, it also means that you don’t have access to the coverage should you become disabled while it’s on hold. When the on hold period ends, you must contact CDSPI and we will reinstate the coverage - no application, no medicals, nothing else is required. We will resume billing. The minimum amount of time to put it on hold is 6 months and the maximum is 36 months unless the hold is due to post graduate studies, then the hold can last the duration of the program. If at any time you'd like to receive your coverage before the hold period expires, just contact CDSPI.

DisabilityGuard is a guaranteed plan which means that neither CDSPI nor Manulife can cancel your policy except for non-payment of premiums.

You are covered anywhere in Canada or the United States. If you are moving elsewhere, let us know and we will work with you to request permission from the insurer.

CDSPI only works with dentists, so our plan is custom designed with the specific needs of dentists in mind. For example, Own Occupation and HIV/Hepatitis B & C coverage are included at no extra cost because those features are especially significant for dentists.

The licensed advisors at CDSPI Advisory Services Inc. work on salary, meaning we work in your best interests rather than being motivated by commissions.

Created by dentists, CDSPI is a not-for-profit organization that helps you achieve and maintain financial well-being with advice, insurance, and investments customized for the needs of today’s dentists. CDSPI operates under the governance of the CDA and participating provincial and territorial dental associations to support Canadian dentists and is offered as an exclusive benefit of membership.

You can have coverage with more than one company and in fact many professionals do. If you do have insurance in multiple places, however, we recommend gaining an understanding of how benefits are paid out with each provider in the event of a claim.

When you have insurance with more than one provider, some companies consider all policies when paying benefits. Some insurers will reduce their benefit payable by the amount of insurance you have with another carrier, even though you’ve paid premiums for the full amount of coverage.

With the CDSPI DisabilityGuard Insurance plan, the policy pays out regardless of whether you have a disability policy elsewhere in the event of Total/Residual disability, unless your DisabilityGuard plan was issued based on our understanding that your Other Insurance was to be cancelled immediately following the Effective Date of your DisabilityGuard coverage. If the Other Insurance is not cancelled, the benefit amount that would otherwise be payable will be reduced by the amount payable to you under the Other Insurance.

It depends on the group policy and the individual policy. Even within those categories, they are not all created equal. The benefit of the group disability insurance plan from CDSPI is that it’s been negotiated with Manulife leveraging the group purchasing power of Canadian dentists. With the support of the dental community behind us we can negotiate with insurers to get competitive pricing and features important to dentists, such as the built-in own occupation definition, automatic HIV/Hepatitis B & C coverage and the waiver of premium while on a disability claim.

Plus, CDSPI works exclusively with dentists and dental students, so we understand your unique needs, risks, and opportunities. Advisors at CDSPI Advisory Services Inc. are non-commissioned and completely objective. That plays out both in the buying process and the ongoing service and claims advocacy.

Just like an individual plan, your rates are guaranteed and, as long as your premiums are paid, CDSPI will never terminate coverage.

There are many factors that can influence the premium of an insurance policy. As you compare policies, it’s important to compare apples to apples and understand the answers to the following questions:

- Do both policies include the same “own occupation” protection and definitions?

- Are you comparing the same premium model (step vs. level)?

- Are the elimination periods the same?

- Is HIV/Hepatitis B & C protection included?

- Is the benefit amount the same?

- What additional options exist within the plan?

- Is there a future insurance guarantee?

- Is there a cost-of-living adjustment? If so, what is the indexing percentage?

- Is there coordination of benefits?

DisabilityGuard has been designed for dentists. One of our insurance advisors would be happy to explain the features of the DisabilityGuard policy so you can understand what it includes and how it compares.

DisabilityGuard Application Process

Complete and submit application

After submitting your application, it will be promptly reviewed by the insurer and you may be contacted for the following:

Routine medical tests

Routine blood, urinalysis, and a medical exam may be required as a part of your application. These tests can be done at your home or office — wherever is convenient for you. A medical services company working on behalf of the insurer will reach out to you to make the arrangements. Depending on your age, the amount of coverage requested and your medical history, a medical report from your physician may also be requested.

Financial information

You may be asked to provide documentation to verify the amount of coverage for which you qualify.

Confirmation of insurance

Once your application is approved, you will receive your coverage details and certificate of insurance and Certificate Booklet containing the terms and conditions of your policy mailed to the address you provided. You can also access your account information by signing into your online account with CDSPI at any time. It is important that you file these documents in a secure location and that you read the policy so you can understand the coverage you own.

Premium payments will begin according to the mode of payment you selected. If your application is approved with changes, you will be sent an amendment form for review and acceptance before the coverage takes effect and premiums begin.

If your application is not approved, you will receive a confidential letter explaining the reason.

How much disability insurance do you need?

Calculate the amount of disability insurance you need depending on your earned income.

Read to take the next steps? Get a quote and start your application

Calculate your monthly premiums and choose from various coverage options. If you're ready to take next steps, you apply online, or if you'd like to review the plan details, including available options, conditions & limitations, and plan eligibility, you can review the plan details.

Our Insurance Advisors can help ensure you're protected

- Receive highly personalized advice based on your lifestyle and your goals.

- Answer any questions you may have about your coverage options.

- Get a tailored quote.

Resources

What Dentists Should Know About Illness and Disability

When Buying a Dental Practice, Ensure you’re Insured

When You Can’t Work

We're Here to Help

Our team is available weekdays, 8:30-4:30 pm EST.

Send us a message

You'll receive a response within 2 business days.

For customized advice, you can meet with a licensed advisor to discuss your needs.

DisabilityGuard Insurance is underwritten by The Manufacturers Life Insurance Company (Manulife), PO Box 670, Stn Waterloo, Waterloo, ON N2J 4B8.

This information is intended for informational purposes only. A full description of coverage and eligibility, including exclusions, restrictions and limitations can be found in the DisabilityGuard™ Insurance Certificate Booklet containing the terms and conditions governing the policy. For specific situations you should consult the appropriate financial, legal, accounting or tax advisor.