There are so many disability insurance products to choose from—each with their own unique options. Sometimes it can be difficult to understand the options available to you, and what is best for your situation. Our DisabilityGuard™1 coverage was created exclusively for dentists, and offers you two choices of how to organize your premium payments, step or level. We break these down for you below, so you can make the right choice for you.2

What is a Step Premium?

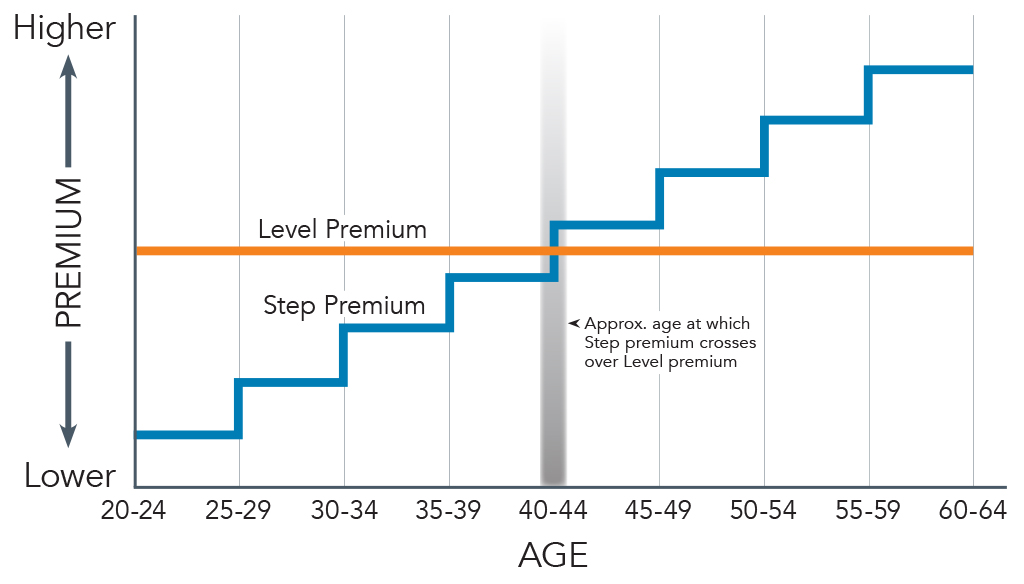

A step premium is a premium that increases in 5-year age bands. You will know the premium rates from the age when you are approved for your policy up to age 65.

What is a Level Premium?

A level premium involves you paying the same premium until the January after you turn 65. The premium will be higher to begin with, but it won’t increase as you age.

Why Choose Step? |

You may consider a Step premium if you would like to begin by paying a lower premium and have the premium increase as your age increases, when your income is more likely to increase as well. |

Why Choose Level? |

You may want to consider a Level premium if you prefer paying a consistent premium until age 65. Your premium will change to Step rates for ages 65-69 and 70-74. |

Whichever you choose your rates are guaranteed...

Step or level, your premiums are guaranteed until age 65.

Starting the January after you turn 65, you will have guaranteed step rates from ages 65-69; and then when you turn 70, your rates from 70-74 will also be guaranteed.

For Students and New Graduates…

If you have our no-cost student package, your DisabilityGuard™ coverage will default to step premiums when you graduate. You can switch and lock in at the lowest possible level rate without medical questions until the end of the year after you graduate, simply return your completed change form to insurance@cdspi.com.

Contact us at 1.800.561.9401 to discuss your options for disability coverage. We want to help you make the best choice for you.

There are many choices that you can make to benefit the health of your finances. Check out these articles for ideas:

The Right Balance is Key to Your Wealth

Choose Life Insurance That’s Right for You

5 Ideas to “Green” Your Home and Save

- The information contained here is a summary A full description of DisabilityGuard™ coverage and eligibility, including restrictions and limitations is contained in the certificate booklet, which sets out all the coverage terms and conditions.

- Clients who are on claim or satisfying an elimination period are not eligible to switch their payment option under DisabilityGuard™ Insurance.

DisabilityGuard™ is a trademark of CDSPI.

DisabilityGuard™ Insurance is underwritten by The Manufacturers Life Insurance Company (Manulife), PO Box 670, Stn Waterloo, Waterloo, Ontario N2J 4B8.

Accessible formats and communication supports are available upon request. Visit cdspi.com/accessibility for more information.