Every month, an insurance premium is deducted from your bank account; representing the confidence of knowing that if you can’t work for medical reasons, you, your family, and your practice will be taken care of.

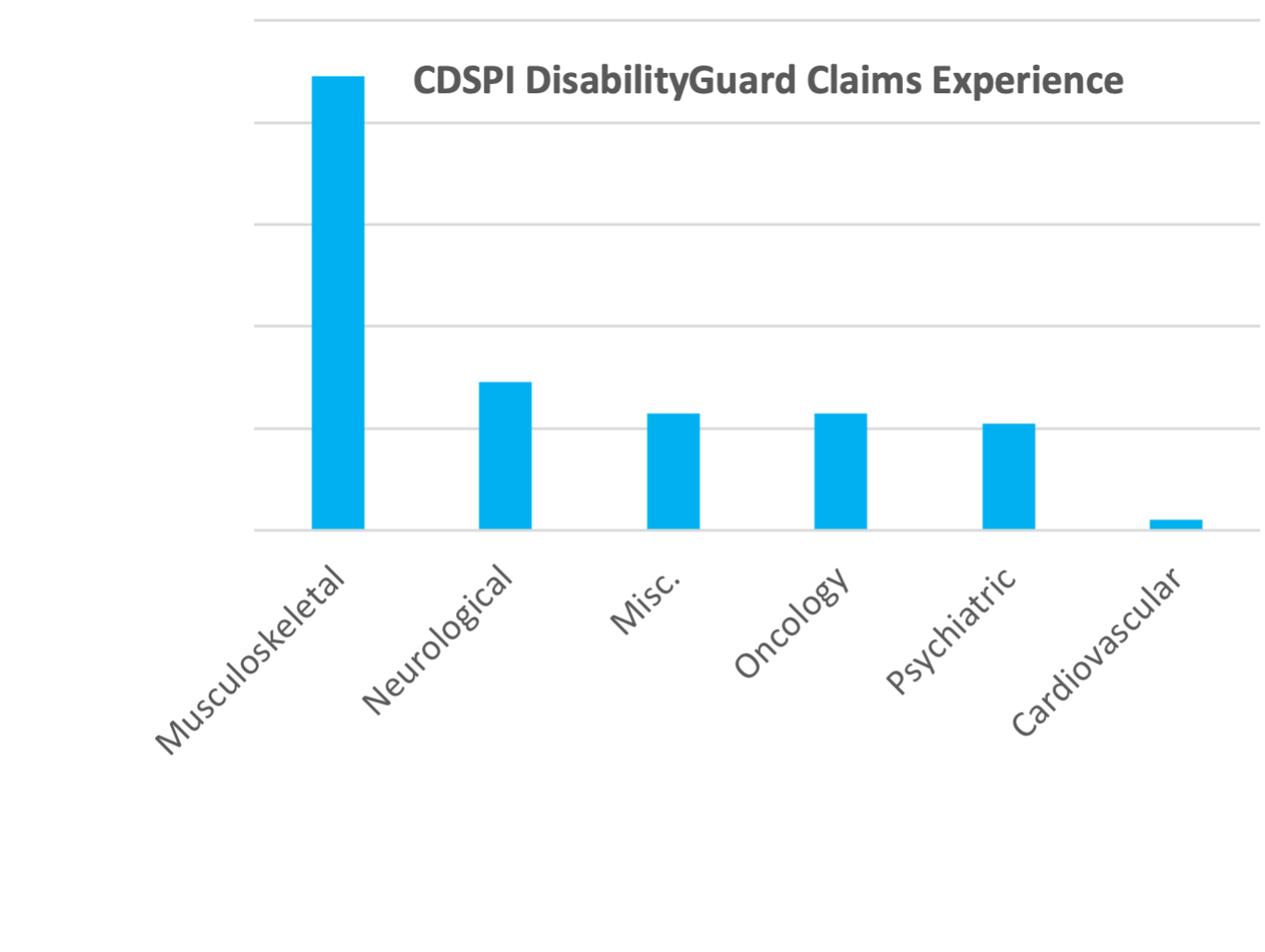

Claims experience for CDSPI clients and for dentists in general shows musculoskeletal claims are the leading cause of disability—in fact, dentists are three times more likely to suffer from a musculoskeletal injury than the next leading cause of disability.1

Musculoskeletal Disorders (MSDs) in Dentists

MSDs are injuries and disorders of the musculoskeletal system which includes muscles, tendons, tendon sheathes, nerves, bursa, blood vessels, joints/spinal discs, and ligaments. While some musculoskeletal injuries can occur from a single injury, the majority “result from repeated strength demands coupled with lack of significant rest periods that together, exceed the tissue tolerance of an individual.”2

These statistics are taken from the 2021 CDSPI Claims Report prepared by The Manufacturers Life Insurance Company (Manulife) for CDSPI.

Therefore, it’s not unexpected to see MSDs being so prevalent as dentists expose themselves daily to the risk factors associated with musculoskeletal disorders including repetition, awkward or static posture, high forces and contact stress that can cause or aggravate these types of injuries.

Researchers have found symptoms of discomfort for dental professionals occurred in the wrists/hands (69.5%), neck (68.5%), upper back (67.4%), low back (56.8%) and shoulders (60.0%). They also found that 93% of those surveyed stated that they had at least one job-related ache, pain, or discomfort in the 12 months prior to the survey. 3

Since an injury lowers one’s capacity and overall tissue tolerance of that area, returning to pre-injury duties before adequate rehabilitation could result in increased risk of developing a more severe or permanent injury or overusing another body part to compensate for the current injury.

Download the booklet from Ontario Health Clinics for Ontario Workers (OHCOW) on Working Posture, Techniques and Exercises designed for dental professions.

To dive deeper into this issue—and explore why some dentists find themselves in this scenario—CDSPI met with Sean O’Neill, Director of the Living Benefits team at Manulife, the insurer who underwrites CDSPI DisabilityGuard.

With more than twenty-one years of insurance claims experience, Sean understands the importance of disability insurance and how a disability can derail your life. “Having a disability policy is the most practical and effective way to protect yourself with a monthly income if you can’t work due to illness or injury,” says Sean.

“For professionals, like dentists, ensuring your policy includes own occupation coverage may also allow you to receive disability benefits if you are able to earn income from an alternative occupation. An example would be a dentist, who is unable to practise clinical dentistry or other jobs/duties they were performing due to an illness or injury, may be able to earn an income doing something else such as a teaching position. Without the own-occupation definition, benefits could be reduced.”

When You Have a Claim

Sean has learned over the years that effective communication—between the dentist and the claims adjustor—is one way to ensure the claims process proceeds smoothly and allows claimants the time to focus on their recovery.

“We see a lot of musculoskeletal claims as the insurer for CDSPI. Recently a dentist filed a claim because of a hand condition that was compromising her ability to practice. In most jobs, when you have a dominant hand that’s injured, you can often compensate using the other hand. But when your job requires the use of a drill and fine motor skills, and you’re working inside someone’s mouth, it becomes problematic. Because we work so closely with CDSPI, our claims adjusters have the knowledge and understanding about how certain injuries impact the practice of dentistry. We were able to work collaboratively with the claims adjuster to get a beneficial resolution to the claim and she received the ongoing benefits she needed.“

Help your insurer help you

Sean ended the interview by saying, “Our goal is to always treat our claimants with care and compassion; the same way that dentists treat their patients. Insurance itself is complex at the best of times. Claims Adjudication is a paper intensive process, but the more information provided upfront, the better. That’s why CDSPI claims tend to be adjudicated faster than others as we get a lot of the financial information at the time of application.”

A small injury or even those first twinges of pain that don’t go away can be a symptom of a larger issue. It’s important to take the time upfront to seek medical help and explore your options early before a small issue evolves into a career-ending situation.

If you’re suffering from a health condition that is impacting your work, the first step after consulting your doctor, is to reach out to your insurance provider for the appropriate forms and then fill them out in as much detail as possible. At this stage, consider explaining why you need to take time off work, the types of restrictions and limitations that preclude you from working, or—if you can work but require rehabilitation—this will help the adjuster understand your injury and the impact on your work.

To support this information, include detailed reports from a family physician or specialist (or both), including copies of the doctor’s clinical notes, if possible. If you were in a car accident, share the police report. Your insurance provider should provide you with the required forms to bring to your doctor—or they may request the information on your behalf, after the claim is submitted. Again, it all comes down to good communication.

Our staff are here to help you understand how the claims process works and what you can expect. CDSPI is also here to help you if you’ve run into any obstacles along the way.

We want to ensure you have comprehensive coverage and features on our products and the best client experience when you have a claim. For this reason, CDSPI regularly solicits feedback through surveys.

Please don’t hesitate to contact CDSPI at claims@cdspi.com or 1.800.561.9401 if there is anything we can do to support you or if you have any questions about your claim.

¹ Ergonomics and Dental Workers, Occupational Health Clinics for Ontario Workers, www.ohcow.on.ca, pg. 1.

² Ibid, pg. 2.

³ These statistics are taken from the 2021 CDSPI Claims Report prepared by The Manufacturers Life Insurance Company (Manulife) for CDSPI.

⁴ Ergonomics and Dental Workers, pg. 2

DisabilityGuard Insurance is underwritten by The Manufacturers Life Insurance Company (Manulife), PO Box 670, Stn Waterloo, Waterloo, ON N2J 4B8.

This information is intended for informational purposes only. A full description of coverage and eligibility, including exclusions, restrictions and limitations can be found in the DisabilityGuardTM Insurance Certificate Booklet containing the terms and conditions governing the policy. For specific situations you should consult the appropriate financial, legal, accounting or tax advisor.