Term 100 Permanent Insurance

Coverage for your entire life and for dental practice partnerships

Make sure that your family will be provided with financial support in the event of your death, whenever that occurs. Also, you may require life insurance for estate planning or other specialized needs. Term 100 meets these needs by offering life insurance coverage for your entire life.

The plan is called Term 100 because you pay premiums up to age 100. The premium amount is guaranteed to remain the same each year.

As well, if you practise in a dental partnership or cost-sharing arrangement, the death of one of the principals could have serious financial consequences. Term 100 Life Insurance can provide partner insurance coverage to give you the financial resources to buy out a deceased partner’s interest in the practice or offset financial losses upon the death of a key person in your practice.

Gain These Advantages

Coverage for your entire life

You'll receive life insurance coverage for your entire life—not up until a certain age as with other insurance policies.

Lump sum benefits

In the event of your death, your beneficiary receives the full sum insured, up to $1-million.

Premiums will not increase

With Term 100 insurance, your premiums are guaranteed to remain the same each year.

Joint life coverage

Joint Life coverage insures two people under one coverage certificate economically.

First to Die joint coverage

First to Die joint coverage is ideal to fund buy-sell agreements.

Last to Die joint coverage

Last to Die joint coverage is ideal to cover taxes deferred to the death of the last surviving spouse.

Eligibility

You are eligible to apply for Term 100 Life Insurance if you are a Canadian resident aged 18 to 70 inclusive, and you are:

- a licensed dentist in Canada, and a member of the CDA or a participating provincial or territorial dental association (in Quebec, only CDA members are eligible)

- a full-time undergraduate or graduate student in a Canadian faculty or college of dentistry

- a full-time employee of a participating dental association or organization

As the Quebec provincial association does not participate, Quebec dentists must be members of the CDA to apply for or increase coverage.

Also eligible to apply for Term 100 Life Insurance are Canadian residents who are:

- the spouse (age 18 to 70) of an eligible dentist, student or dental organization employee

- children of an eligible dentist, student or dental organization employee (children must be at least 18 but need not be dependent)

- the spouse of an eligible child

In order to qualify for new coverage, evidence of good health must be provided. Coverage is subject to approval by the insurer. If you are 70 or under, you can convert your CDSPI Basic Life and/or CDSPI Family Life coverage to Term 100 Life Insurance without providing evidence of good health.

How Term 100 Life Insurance Protects Your Family or Dental Practice

In the event of your death, your beneficiary receives the sum insured, up to $1-million.

You can use Term 100 Life Insurance to protect your family, or insure a key person in your practice or a buy-sell agreement in your dental partnership or cost-sharing arrangement.

Your Premium Remains the Same to Age 100

The premium you pay in year one is the exact same amount you pay each and every year. The amount is guaranteed not to increase (unless you exercise the Indexing Option).

Should the insured individual live to age 100, two choices are available:

- coverage continues without further premiums being paid

- coverage terminates and you receive a payment of the full insurance amount

Receive Advanced Funds in the Case of Terminal Illness

A terminally ill person who has a prognosis of death within 12 months and who has coverage that has been in effect for at least two years may apply for an advance of up to 50% of the sum insured to a maximum of $100,000. The insured must submit medical evidence to the insurer to support the application. Payment is subject to approval by the insurer. At time of death, the amount paid will be the face amount less the amount previously advanced.

Joint First to Die Coverage

Insures two people under one certificate. The insurance amount is paid to the beneficiary upon the death of the first insured individual. Coverage then terminates.

Joint Last to Die Coverage

Insures two people under one certificate. The insurance amount is paid to the beneficiary upon the death of the second insured individual. Premium payments continue until the earlier of the following events: the 100th birthday of the second insured individual or the death of the second insured.

Options

Waiver of Premium Option:

Pay no premiums when totally disabled*

With the Waiver of Premium Option, you pay no premiums that are due during the period when the insured individual has a total disability lasting six continuous months or longer.

During the first six months of total disability, you continue to pay your premiums, but these premiums are refunded upon the insurer’s acceptance of the disability claim. Premiums will continue to be waived for as long as the insured individual remains totally disabled. The disability must commence before the policy anniversary closest to the insured individual’s 60th birthday.

An insured individual is considered totally disabled when, as a result of sickness or injury, the person is unable to engage in any gainful occupation for which he or she is qualified by reason of education, training or experience.

This option is available for ages 18 to 54 inclusive.

*Certain causes of disability, such as disabilities resulting from self-inflicted injuries, insurrection or war, committing a criminal offence, provoking an assault or participating in a riot or civil commotion are excluded from this option. Further details are provided in the certificate booklet issued to you upon approval of your coverage.

Indexing Option:

Increase coverage by 40 per cent over five years

With the Indexing Option, your coverage can increase by 8 per cent of the original insurance amount on your policy anniversary for the first five years. You must apply for this option when you first purchase Term 100 coverage. If you wish, you can end the coverage increases in any of the five years. But then you can’t resume the coverage increases in a later year.

No additional medical information is required at the time of application for the Indexing Option and the five coverage increases. The cost of each increase is based on your age (joint insurance age for joint coverage) when you originally purchased Term 100 coverage.

This option is available for insureds whose age and joint insurance age are 18 to 64 inclusive.

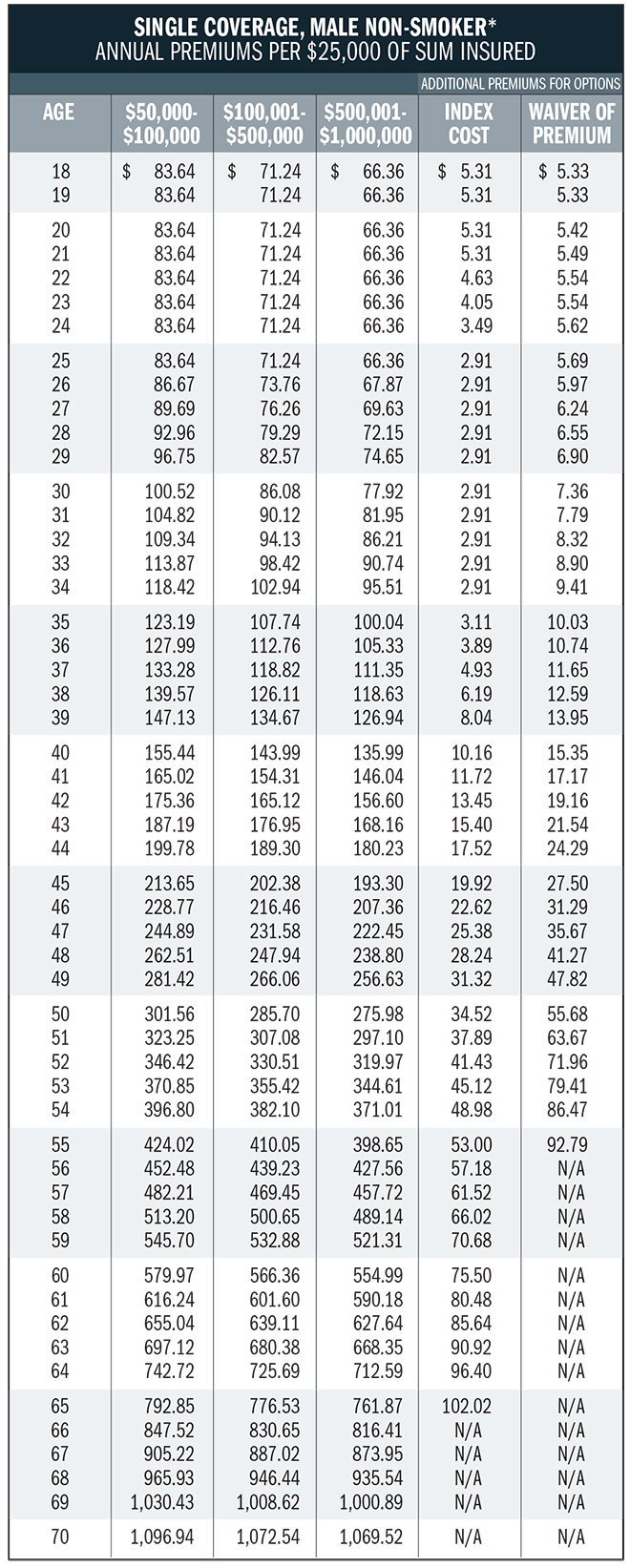

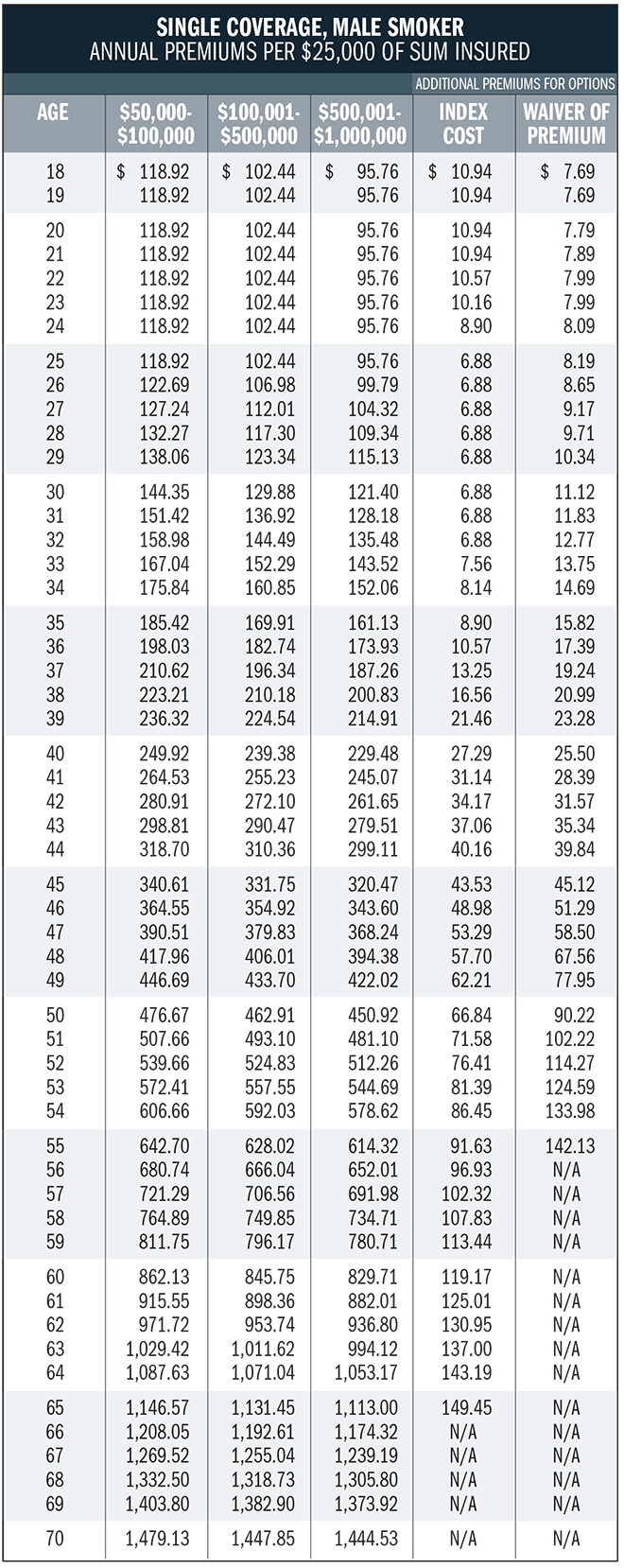

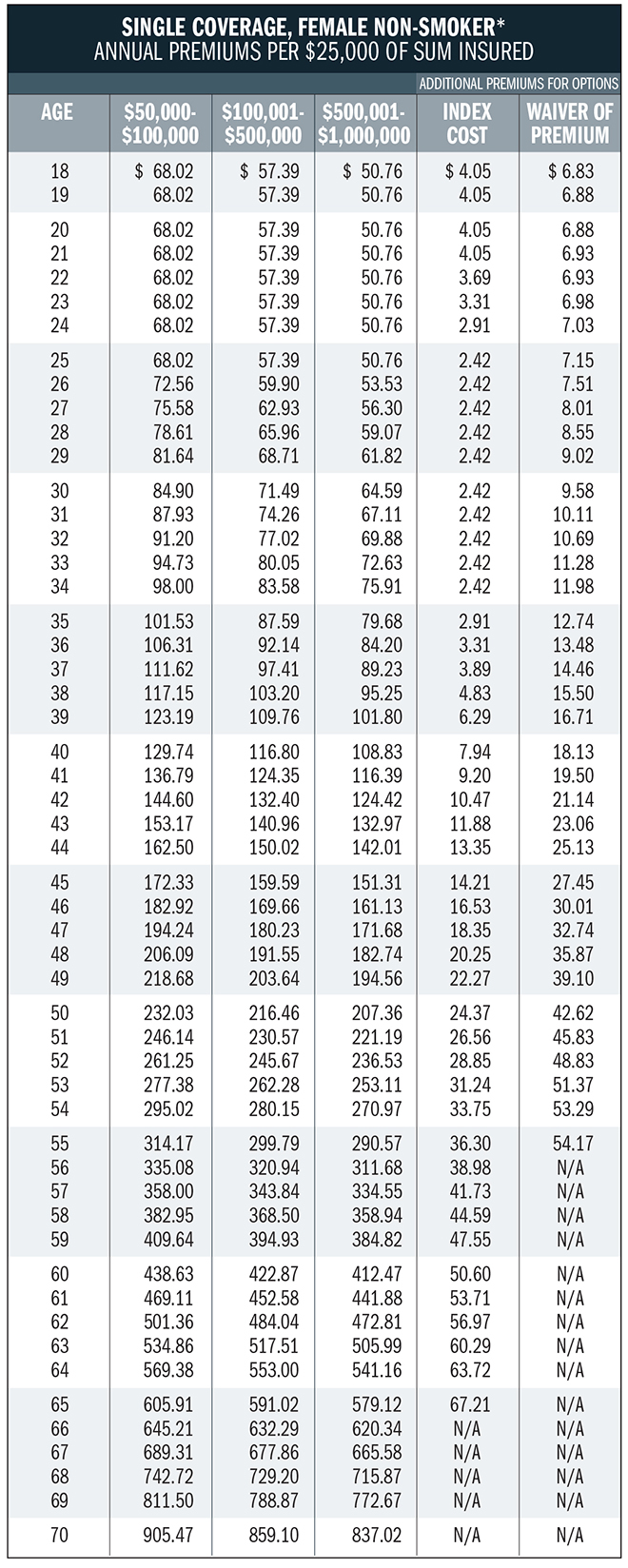

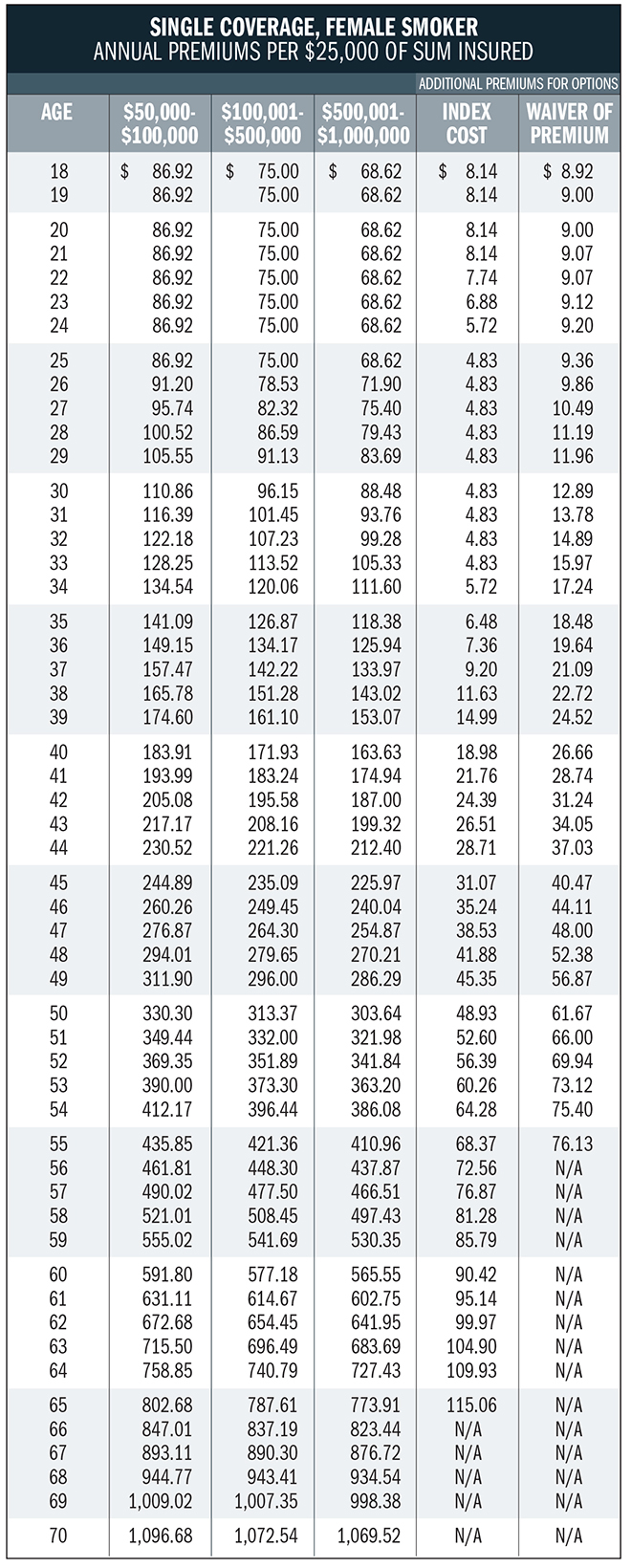

Annual Premium Rates and Insurance Limits

Provincial taxes are extra where applicable under provincial laws.

Coverage is available in units of $25,000. Minimum coverage is $50,000; maximum coverage is $1,000,000.

Use your nearest age to calculate premiums. (If you are applying six months or more after your last birthday, use the age you’ll be on your next birthday.)

Note that the following premiums are standard rates, which apply to individuals in good health. Applicants with certain medical conditions or concerns may still be accepted for coverage, but at higher premium rates.

For the cost of the joint life plans, call CDSPI Advisory Services Inc.

Conditions and Limitations

Please note that suicide of the insured, while sane or insane, within two years of the effective date or date of last reinstatement is not covered.

This information is presented for your general guidance. Precise details, terms and conditions (including restrictions and exclusions) are set out in the insurance contract for this plan.

We're Here to Help

The Term 100 Life Insurance plan is underwritten by The Manufacturers Life Insurance Company (Manulife).