Disability Insurance for Dentists

Protect your lifestyle and your income with DisabilityGuard™.

Just about everything you plan on accomplishing in the future is based on the expectation that you will continue to earn an income. That income is what will allow you to support yourself, your family and achieve your goals. That’s where disability insurance for dentists comes in and why DisabilityGuard Insurance can play a role in maintaining your lifestyle. If you suffer a disabling illness or injury, the plan provides you with a monthly income benefit of up to $25,000 to help replace your lost income.

DisabilityGuard Plan Features

Own Occupation

The most comprehensive definition of own occupation coverage available which protects your ability to work in dentistry—plus it's included at no extra cost.

What this means is you can still receive disability benefits even if you are able to earn income from a new occupation. An example would be a dentist, who due to Parkinson's disease can no longer practice clinical dentistry, but could earn an income doing something new and unrelated to their regular/own occupation, such as teaching dentistry. Without the own occupation definition, benefits would likely be reduced or even cut-off completely.

Read the plansheet for complete plan details as well as all available options.

Webinar: Understanding Disability Insurance for Dentists

Learn more about the recent changes in the disability insurance market and any impact they might have on Canadian dentists and dental students. Also covered are:

- Key considerations for ensuring your disability coverage protects you and your family.

- Features of DisabilityGuard that are tailored to dentists, including: guaranteed premiums; non-cancellable coverage to age 75; and own occupation built right into the contract.

- Watch here and take a quiz to earn a certificate of attendance

FAQs

DisabilityGuard Application Process

Complete and submit application

After submitting your application, it will be promptly reviewed by the insurer and you may be contacted for the following:

Routine medical tests

Routine blood, urinalysis, and a medical exam may be required as a part of your application. These tests can be done at your home or office — wherever is convenient for you. A medical services company working on behalf of the insurer will reach out to you to make the arrangements. Depending on your age, the amount of coverage requested and your medical history, a medical report from your physician may also be requested.

Financial information

You may be asked to provide documentation to verify the amount of coverage for which you qualify.

Confirmation of insurance

Once your application is approved, you will receive your coverage details and certificate of insurance and Certificate Booklet containing the terms and conditions of your policy mailed to the address you provided. You can also access your account information by signing into your online account with CDSPI at any time. It is important that you file these documents in a secure location and that you read the policy so you can understand the coverage you own.

Premium payments will begin according to the mode of payment you selected. If your application is approved with changes, you will be sent an amendment form for review and acceptance before the coverage takes effect and premiums begin.

If your application is not approved, you will receive a confidential letter explaining the reason.

How much disability insurance do you need?

Calculate the amount of disability insurance you need depending on your earned income.

Read to take the next steps? Get a quote and start your application

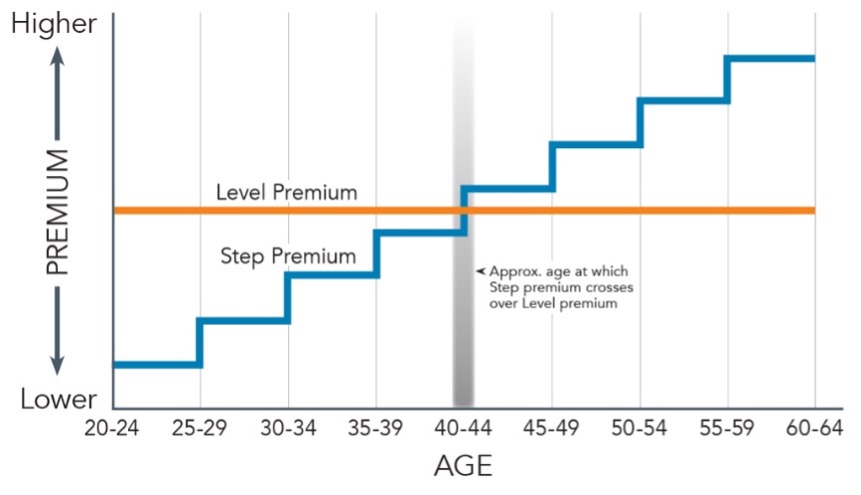

Calculate your monthly premiums and choose from various coverage options. If you're ready to take next steps, you apply online, or if you'd like to review the plan details, including available options, conditions & limitations, and plan eligibility, you can review the plan details.

Our Insurance Advisors can help ensure you're protected

- Receive highly personalized advice based on your lifestyle and your goals.

- Answer any questions you may have about your coverage options.

- Get a tailored quote.

Resources

What Dentists Should Know About Illness and Disability

When Buying a Dental Practice, Ensure you’re Insured

When Disability Keeps You From Working

A Personal Experience With a Career-Changing Disability: Dr. Jeff Williams

We're Here to Help

Our team is available weekdays, 8:30-4:30 p.m. ET.

Send us a message

You'll receive a response within 2 business days.

For customized advice, you can meet with a licensed advisor to discuss your needs.

DisabilityGuard Insurance is underwritten by The Manufacturers Life Insurance Company (Manulife), PO Box 670, Stn Waterloo, Waterloo, ON N2J 4B8.

This information is intended for informational purposes only. A full description of coverage and eligibility, including exclusions, restrictions and limitations can be found in the DisabilityGuard™ Insurance Certificate Booklet containing the terms and conditions governing the policy. For specific situations you should consult the appropriate financial, legal, accounting or tax advisor.