Planning for the eventual transfer of your dental practice or corporate wealth requires foresight and careful planning. Taking a longer-term approach is especially important when employing advanced planning strategies such as an estate freeze. An estate freeze can help dentists lock in tax advantages, preserve family wealth, and transition their business smoothly to the next generation.

This article breaks down what an estate freeze is, why it’s relevant to dental professionals, and how it plays out in real life. It draws heavily from insights shared by tax and legal experts during sessions of the “Navigating Death and Taxes” panel, hosted by CDSPI at dental conferences across Canada in 2025.

What is an Estate Freeze?

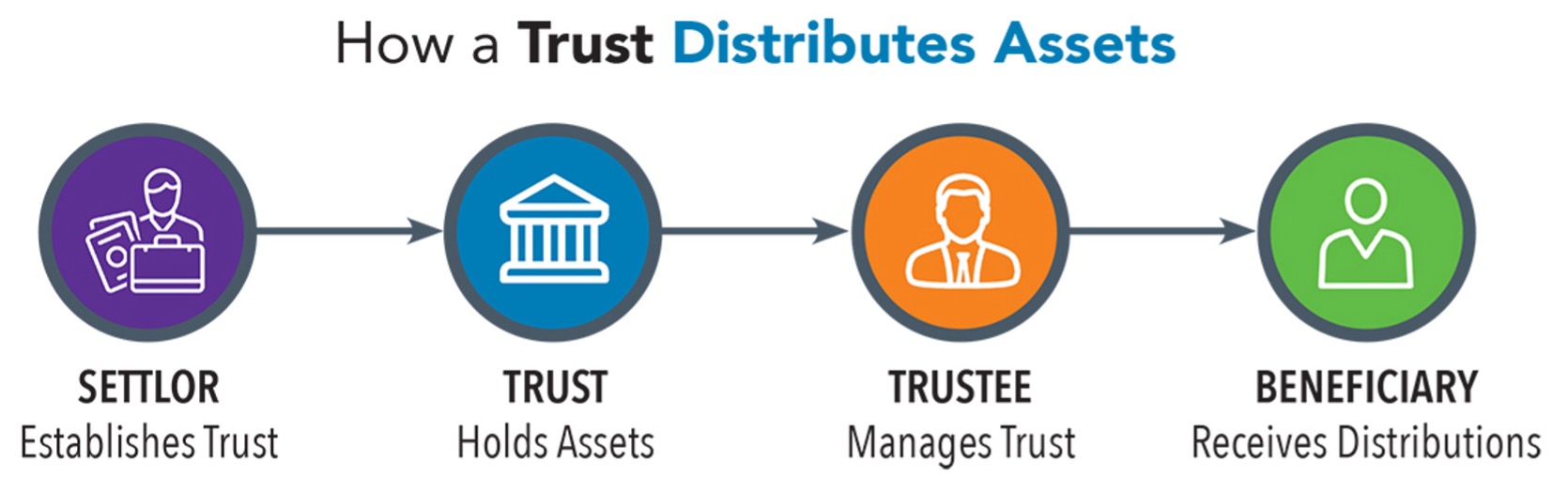

At its core, an estate freeze is a way to lock in the current value of your business or investment holdings so that any future growth accrues to someone else such as your children, a trust, or a holding company set up for your heirs. According to Jordan Weinberg, Partner and Business Advisor with MNP’s Professionals Services group: “You freeze the current value of your shares by converting them to preferred shares and then issue new common shares to your children or a trust for their benefit. Those new shares are worth zero now, but they capture all the future growth.”

An estate freeze works by capping your future tax liability since you're no longer personally responsible for taxes on the growth after the freeze. An estate freeze helps to enable intergenerational wealth planning without triggering immediate tax on the business or asset being frozen.

Time is Everything

One of the biggest mistakes dentists make is waiting too long to freeze. If the practice grows substantially before you implement a freeze, you could exceed your LCGE and face significant tax on the appreciation.

As Jordan Weinberg puts it: “You can’t go back in time. If your practice has grown from $1 million to $3 million and you haven’t done a freeze, that extra $2 million might now be taxable when you sell.” Freezing early, before significant growth or a pending sale, helps to ensure that more of the future value can be sheltered or shifted tax-efficiently.

Why Should Dentists Care?

For dentists operating a successful practice or with significant corporate investment assets, an estate freeze can protect your lifetime capital gains exemption (LCGE) and ensure that future appreciation flows to your family rather than the taxman.

As Jordan Weinberg explained: “If you do this right, you could potentially sell your practice for as much as $4 million and not pay tax on the first $1.25 million, provided the shares qualify under the lifetime capital gains exemption.”

He further noted that with thoughtful planning, and if there are multiple family members or trusts are involved, it’s possible to multiply the LCGE across different beneficiaries.

An Estate Freeze in Four Steps

Here's a simplified step-by-step version of how a freeze might be executed:

VALUATION:

A fair market valuation of your dental practice or corporation is conducted.

SHARE REORGANIZATION:

You convert your current common shares into fixed-value preferred shares, locking in your interest at today’s value.

NEW COMMON SHARES ISSUED:

New common shares (worth essentially nothing today) are issued to your children or to a trust for their benefit. These shares will grow in value over time.

ESTATE PLANNING COORDINATION:

The freeze is often paired with a shareholders’ agreement, trust documents, and other estate planning tools to define how those new shares can be sold or transferred in the future.

Real-World Example: Passing on a Dental Practice

During the panel, one case study illustrated a dentist looking to retire and transition ownership to her adult children. The practice was still active, with goodwill and real estate assets embedded in the corporation.

Jordan described a typical sequence. “We do the freeze at today’s value. The dentist now holds fixed-value preferred shares, and her kids hold the common shares through a family trust. The trust will now receive any appreciation in the practice or in the investment account.” He explained that this approach allowed the family to defer taxation, protect future value, and maintain control of the transition process. Importantly, the structure also opened the door for a capital gains exemption on the eventual sale.

Flexibility vs. Finality

A key consideration is control. Once frozen, the value of your preferred shares is fixed. But you still retain some key areas of flexibility, including:

Receiving dividends from the preferred shares

Retaining voting control through dual-class share structures

Use a discretionary family trust to allocate future growth among children or other beneficiaries

The panel was at pains to point out that once invoked, you cannot unwind the freeze easily. It becomes a “one-way street,” or as Raphael Tachie, a Partner at the law firm Dentons put it: “This is a permanent restructuring. You don’t want to rush into it. You want the right advisors—legal, tax, and financial—to walk you through the implications.”

What Happens on Death

Upon death, under the estate freeze, the preferred shares are deemed to be disposed of at fair market value, potentially triggering capital gains tax. However, if the shares qualify, your estate can claim the LCGE and offset some or all of the tax.

If the shares are left to a spouse, the estate can claim a spousal rollover, deferring tax until the spouse’s death. “If everything is left to a spouse, then you don’t trigger tax at death, Jordan pointed out. “But if you go straight to your kids, that’s when the deemed disposition hits, unless you've structured properly.”

Raphael summarized the intent behind an estate freeze : “To put it bluntly, the ideal way to die is how you came into this world: die with nothing. The freeze is a way of trying to die with nothing. You lock in your estate now, and all the future value moves to your heirs.”

Pairing with a Holding Company or Trust

Estate freezes are most effective when paired with a family trust or a holding corporation. A trust gives flexibility in allocating income or future share proceeds to children, while the holding company can separate practice assets from investment or insurance assets.

However, dentists should be aware of regulatory limitations in their jurisdiction. As Jordan pointed out as an example: “In Ontario, the Royal College of Dental Surgeons of Ontario doesn’t allow a trust to own shares in your professional corporation. So, you wouldn’t typically do a freeze with a trust while you're still operating. Instead, you’d freeze and transfer value into a ‘Holdco’ or personal trust after you exit practice.”

What are the Risks of an Estate Freeze?

An estate freeze is not without its complications:

- Valuation disputes can arise with the Canada Revenue Agency (CRA) if the value at the time of freeze is too low

- Family disagreements over trust terms or share ownership can cause friction

- Creditor and divorce claims must be carefully planned for using shareholders’ agreements and family law protections

Raphael cautioned that an estate freeze within the context of a blended family presents a host of potentially thorny complications. He suggested that “it’s even more important to think through who gets what, and under what conditions.” Trust structures and shareholder agreements should specify how shares are treated in the event of divorce, remarriage, or incapacity.

Timing, Teamwork, and Long-Term Strategy

Your financial advisor plays an important role when considering an estate freeze by helping to identify when the timing is right and ensuring the overall strategy aligns with your broader financial goals. During the panel discussion, Shane Dewling, Investment Planning Advisor at CDSPI Advisory Services Inc., emphasized that: “the financial advisor is often the first to spot when a client’s corporation has grown to the point where a freeze makes sense”.

He explained that a financial advisor can help evaluate your corporation’s value and growth trajectory to determine if a freeze could help minimize your eventual tax liability. They can also coordinate with your tax accountant and estate lawyer to implement the freeze in a way that preserves your LCGE and supports your current financial needs.

Your financial advisor will also help design cash flow strategies for the preferred shares (post-freeze), ensuring you can still receive retirement income from the corporation. They can also assist your heirs or trust beneficiaries in managing the proceeds, including setting up investment strategies, planning distributions, or integrating life insurance for liquidity.

Adding your advisor early in the planning process ensures your estate freeze fits within your broader retirement, insurance, and family goals, not just your tax ones. As Shane put it: “It’s not just about the tax savings. It’s about having a strategy for what happens next. We’re here to make sure your plan doesn’t just work on paper, but in real life.”

Bottom Line: Should You Consider an Estate Freeze?

If you own a dental practice, hold significant corporate investments, and/or have a long-term vision of passing on wealth in a tax-efficient way, an estate freeze could be worth exploring. Estate freezes are not just about tax efficiency. They can also help you control the distribution of your assets, execute your succession plan, and create peace of mind for yourself and your loved ones.

As the panelists at our “Navigating Death and Taxes” sessions emphasized, an estate freeze is not a DIY strategy. To design a structure that works for your family and goals, having the right team of advisors – including your accountant, a tax lawyer, and an experienced financial advisor – is essential.

Next Steps

Speak with a financial advisor about whether a strategy that includes an estate freeze makes sense for your situation, particularly if you're approaching retirement or have adult children you’d like to involve in your business or corporate assets. The earlier you start planning, the more flexibility and value you could retain.

This article is for general informational purposes only and is not intended to provide tax, legal, or financial advice. While we strive to provide accurate and current information, we make no guarantees regarding its completeness or applicability. Please consult with qualified tax, legal and financial professionals to discuss your specific needs.