When Dr. Priya Kunan (not her real name) started thinking about her estate plan, one question stood out: "How do I make sure my kids inherit wisely, not just quickly?" With one child still a teenager and another managing a developmental disability, simply leaving everything outright didn’t sit right. "They each need different kinds of support. I want to protect them without tying their hands forever."

It’s a common situation. Many dentists have accumulated significant assets through their professional corporations and holding companies. The wealth in your dental professional corporation represents decades of hard work, and a simple will may not adequately protect it or serve complex familial needs. Trusts, on the other hand, give you strategic control over how your assets are preserved, protected, and distributed according to your values, while minimizing taxes and preventing family disputes that basic estate planning can't address.

What Is a Trust?

Trusts were a hot topic at an expert panel discussion hosted by CDSPI at dental conventions across the country, titled, “Navigating the Inevitable: Strategies for Dentists to Minimize the Risks of Death & Taxes”. While our experts debated the finer points of trusts, one thing they agreed on was the importance of understanding what trusts are and, perhaps more importantly, what they are not.

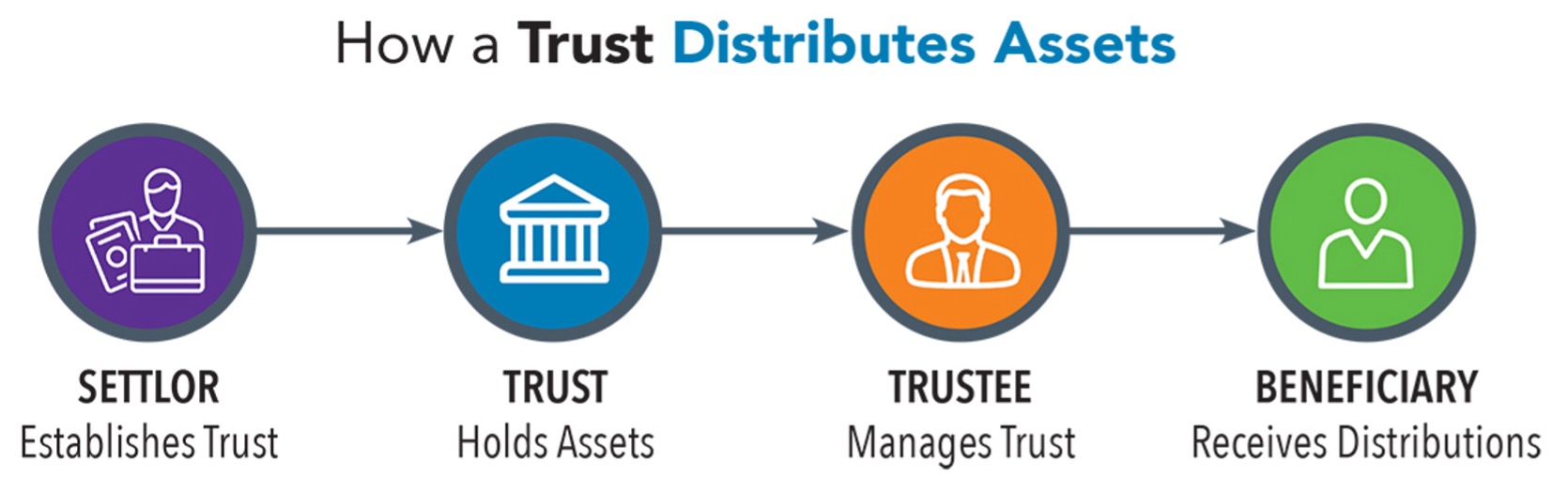

A trust is a legal structure or relationship where one person (the settlor) transfers property to another person (the trustee) to be held and managed for the benefit of one or more beneficiaries.

A trustee is a person or institution you appoint to manage the assets according to rules you set out. The trustee could be a spouse or other family member or friend, or a neutral party such as a financial or legal advisor. The decision of who to appoint depends heavily on your specific circumstances, your goals (such as protecting minor children, providing for a spouse, ensuring the continuity of your practice, or managing accumulated wealth), and the capabilities and trustworthiness of the potential appointees.

There are many types of trusts, but most dentists use two with key purposes:

- Testamentary trusts, created in your will to support beneficiaries after your death

- Inter vivos (living) trusts, created during your lifetime for planning, protection or tax purposes

Raphael Tachie, a Partner at the law firm Dentons, who participated in the CDSPI panel at the 2025 Pacific Dental Conference, put it starkly in perspective: "The ideal way to die is how you came into this world: die with nothing. A trust is one of the tools that helps make that possible".

In Dr. Priya Kunan’s case, with her the focus on providing for children upon her death, the trusts for her children would most likely be testamentary trusts established within her will. She can appoint a trustee to manage the inheritance for her teenage child until they reach a specific age and set rules for how the money can be used or distributed before the child receives it outright, such as paying for tuition directly. This aligns with her goal of ensuring the child inherits "wisely, not just quickly".

In the case of her child with a disability, it would require careful planning and consideration to provide them with the necessary supports and protections such as those available through a formal Henson trust (see above). This trust structure would allow Dr. Kunan to provide different kinds of support and manage the assets in a way that caters specifically to this child's unique needs and circumstances.

Trusts and Your Larger Estate Plan

Shane Dewling, a Financial Planning Advisor at CDSPI Advisory Services Inc., cautions his clients not to view a trust as a solution in and of itself. "Don’t think of a trust as the whole plan,” he says, “it’s a tool. It only works if everything else is aligned".

Trusts often work best alongside:

- Estate freezes: lock in current value and shift growth to beneficiaries or a trust

- Capital Dividend Account (CDA) planning: ensure tax-free payouts to heirs

- Shareholder agreements: coordinate rights and protections in family-owned holding companies

What Trusts Can't Do (for Dentists in Practice)

While trusts are a versatile and powerful tool, they come with restrictions. For example, in Ontario, the Royal College of Dental Surgeons of Ontario prohibits trusts from owning shares in their Dental Professional Corporation while the dentist is actively practicing. That said, a trust may still be used in a holding company or once you’ve exited the practice.

Next Steps

A trust can be one of the most effective ways to protect family wealth, especially in families with unique needs, vulnerable beneficiaries, or complex dynamics. But it isn’t a simple plug-and-play solution. Having the right legal structure, a trustee you have confidence in, and an advisor you can rely on are essential to ensuring the trust supports your overall financial and estate plan.

The earlier you begin, the more flexibility and value you could retain. Speak with a financial advisor to get started.

This article is for general informational purposes only and is not intended to provide tax, legal, or financial advice. While we strive to provide accurate and current information, we make no guarantees regarding its completeness or applicability. Please consult with qualified tax, legal and financial professionals to discuss your specific needs.