The co-insurance clause is a clause found on CDSPI’s TripleGuard™ Building Insurance. It’s important to understand how it works because it affects the amount payable in the event of a claim.

A co-insurance clause means that the amount of insurance you purchase (to replace the property in the event of a loss) must equal or exceed a specified minimum percentage of the replacement cost value of the insured property at the time of loss. In the case of the CDSPI TripleGuard Building policy, this co-insurance percentage is 90%. This co-insurance percentage can be found on your Memorandum of Insurance for your TripleGuard Building policy.

How Does Co-Insurance Work?

Below is an example to help you understand how the co-insurance clause applies.

Aleema owns a dental practice in a property she purchased several years ago. At that time, she purchased TripleGuard Building insurance coverage of $500,000. Since then, the property value has increased to a current replacement cost value of $1,000,000.

Unfortunately, a fire causes $250,000 worth of damage to Aleema’s building.

You might assume that since the amount of coverage is higher than the cost of the damage ($500,000 vs. $250,000), that the insurer would pay $250,000. However, because of the 90% co-insurance clause, this is not the case.

To determine how much to pay on a claim, the insurer will use the following formula:

Actual amount of insurance

x

Amount of Loss

= Amount of claim to be paid by the insurer

Minimum required amount of insurance

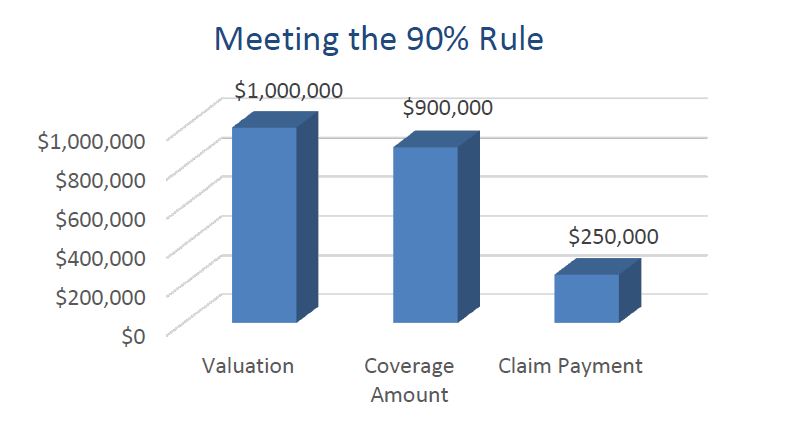

Scenario A - Property insured at 90% of co-insurance requirement

If Aleema was carrying insurance of $900,000 (90% of the $1,000,000), she would have met the minimum amount of insurance required under the co-insurance clause, and she could have recovered her full loss of $250,000.

- Building and Contents Value: $1,000,000

- Co-insurance Requirement: 90%

- Required Amount of Insurance: $900,000

- Actual Amount of Insurance: $900,000

- Amount of Loss: $250,000

Formula:

$900,000 x $250,000 = $250,000 to be paid by the insurer

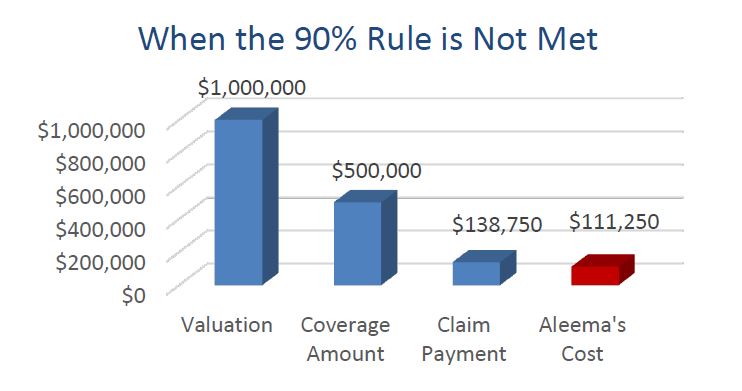

Scenario B - Property not insured at 90% of co-insurance requirement

Since Aleema was underinsured considering the increased value of the property and the insurance available was less than what is required by the co-insurance clause ($500,000 vs $900,000), she is under insured. This means the co-insurance clause activates:

- Building and Contents Value: $1,000,000

- Co-insurance Requirement: 90%

- Required Amount of Insurance: $900,000

- Actual Amount of Insurance: $500,000

- Amount of Loss: $250,000

Formula:

$500,000 x $250,000 = $137,500 is paid by the insurer which means Aleema has to cover $111,250

As you can see from this example, it is important to ensure your property has at least the minimum required coverage it needs so you do not end up paying a co-insurance penalty.

Factors such as inflation, the changing costs of construction materials, or renovations can affect the replacement value of your property, so it’s important that you review your coverage annually or whenever there is a change in your circumstances and to adjust your coverage to remain fully protected.

If you are still uncertain about how co-insurance works with your TripleGuard Building policy or want to discuss your coverage amount, contact an advisor with CDSPI Advisory Services Inc, who can give you advice on what to do in order to ensure you are adequately protected so that your coverage meets the 90% co-insurance clause.

TripleGuard™ Insurance is underwritten by Zurich Insurance Company Ltd (Canadian Branch).

The information contained here is a summary only. A full description of coverage and eligibility, including exclusions, restrictions and limitations can be found in the CDSPI TripleGuard™ Building Policy Terms and Conditions.