When you look at the returns for your investment funds, the fund fees, or MERs (management expense ratios), are already included, so they’re essentially invisible. This may lead some people to ignore these fees, or even assume they don’t matter that much.

But if you do the math, you see they matter very much over time. Lower fees will not only boost your yearly returns, but the power of compounding increases your advantage significantly over time.

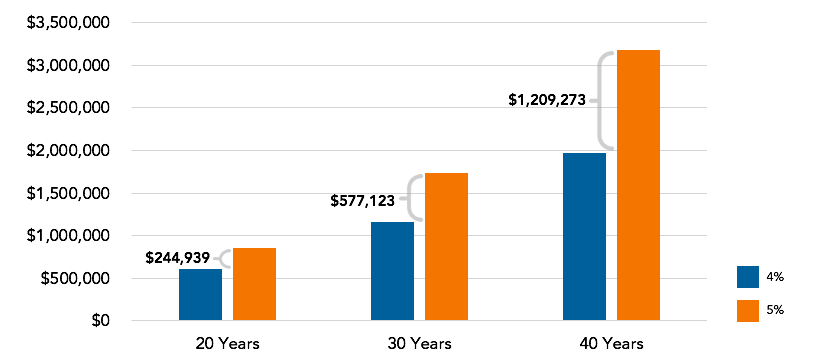

This chart shows how a 1% fee difference makes a huge impact on a million-dollar investment over 20 years.

The 1% Difference

The MERs for CDSPI funds are, on average, 1% lower than for comparable funds. This advantage is available to all dentists, families and staff as a member benefit of your dental association.

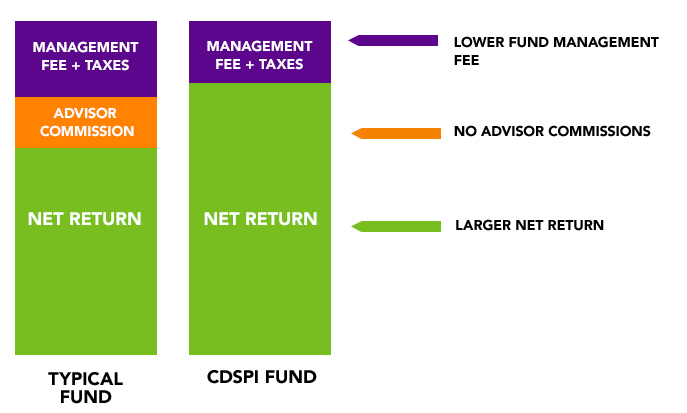

We’re able to provide this advantage for two reasons:

- We’ve negotiated preferred rates with the fund management companies who manage our funds.

- Our advisors are not paid a commission. Apart from lowering your cost, the added benefit is that their advice is completely objective.

With CDSPI your MER is reduced in two way

In addition to a fund’s MER, there may be front- or back-end loads—fees that may add to the cost of your funds depending on when you redeem them. With CDSPI funds, there are no loads or other hidden costs that could erode the value of our investment.

Fees matter, especially in the long term. It pays to pay attention to them.

Apart from fees, there are many other ways to help boost your returns: