Laddering is a straightforward, low-risk investment strategy that involves systematically investing a set amount at regular intervals in low-risk investments like government or corporate bonds and guaranteed investment certificates (GICs) with varying maturity dates. This approach provides a disciplined framework to follow to enhance your investment portfolio while reducing interest rate risk.

It works by spreading your investments across different maturities so that you're never locked into any single long-term commitment. If interest rates rise, you can reinvest the proceeds at higher rates. Conversely, if rates decline, a portion of your portfolio is still earning at the higher initial rates. The result is a diverse portfolio of fixed-income securities maturing at different intervals. This diversification helps manage interest rate risk and provides liquidity as bonds or GICs mature periodically.

Building your ladder

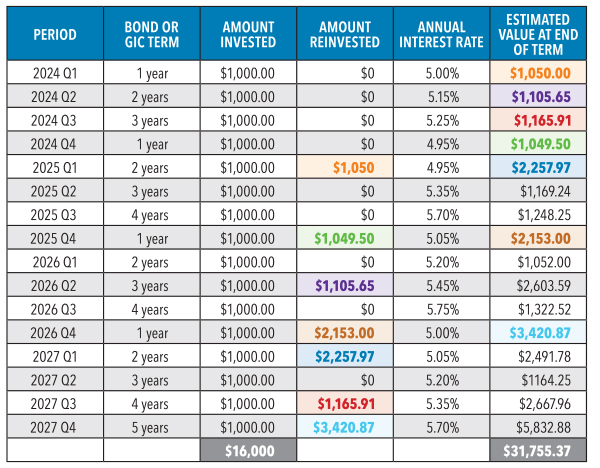

The example below outlines a strategy where you buy $1,000 worth of bonds and GICs every quarter for four years and re-invest the proceeds (see the colour-coded numbers below). To keep it simple, the bonds and GICs in this example compound interest annually:

In this scenario, your $16,000 investment over four years is projected to virtually double by the maturity date of the last bond or GIC. If you’re wondering if there is some kind of magic involved, there is. It’s the alchemy of compound interest, where the interest you earn is reinvested to earn more interest.

The result is a diverse, low-risk portfolio that helps manage interest rate risk while still providing medium- and long-term liquidity since the bonds or GICs on your ladder mature periodically. It also allows you to benefit from potentially higher yields associated with longer-term commitments.

If this strategy appeals to you, remember interest rates are not always going to be as high as they are right now, so the sooner you start the better.

How does laddering work with my RRSPs?

Laddering is great for long-term saving inside your RRSPs since it works best with fixed-income investments like bonds and GICs which are widely available for this type of account. Making regular contributions to your RRSPs helps ensure that you take advantage of the tax deferral and sheltering these accounts offer.

While it is possible to use laddering in your TFSAs or in a First Home Savings Account (FHSA), you should consider the time horizons for any of your saving goals before locking funds into a multi-year bond or GIC. Investments that offer greater liquidity like money market funds or high-interest savings accounts could be a good alternative if you believe you will need access to your money in the short term.

Keep in mind that all these accounts have annual contribution limits and there can be tax consequences for early withdrawals from RRSPs and FHSAs.

Think you know your stuff? Take the quiz!

Taking the first step on the ladder

While the example of laddering used here is simple, it can become very complex to manage when planned over many years and based on more frequent intervals (i.e., monthly, or even weekly). If you want personalized advice on implementing a laddering strategy tailored to your financial goals, you can speak with a Certified Financial Planner® professional at CDSPI Advisory Services Inc. at no cost to you. They can help assess your risk tolerance, define your objectives, and create a customized plan to suit your needs.

Book a meeting to start a conversation about enhancing your investment strategy with a little laddering magic.