CDSPI’s Granite Portfolio managers take active steps to counter the effects of COVID-19.

CDSPI Granite Portfolios, managed by Sun Life Global Investments, are designed to help you achieve financial security with less worry in all market conditions. Each portfolio consists of a broad number of quality domestic and global funds, and the managers shift the asset mix in response to economic indicators, market fluctuations and forecasts.

Sadiq S. Adatia, Chief Investment Officer and Kathrin Forrest, MA, CFA, Portfolio Manager at Sun Life Global Investments, explain the current market outlook and steps they are taking to manage the effects of the coronavirus.

After the World Health Organization warned of a possible coronavirus (COVID-19) pandemic, equities fell for the fifth straight day on February 26. Investors, looking for a possible safe haven, and worried about potentially slower global growth, flooded into U.S. Treasuries, with 10-year yields falling to a near record low of 1.35%.

At the time of writing, the virus has claimed almost 3,000 lives, nearly all of them in mainland China. The country’s attempts to control the spread of the virus have led to a sharp slowdown in manufacturing and consumer spending. There are worries that other countries will face similar disruptions, leading to a worldwide slowdown.

The deep selloff in equity markets and mounting economic fears, have raised expectations that central banks could lower interest rates to support growth. And money markets have priced in roughly two 25-basis-point rate cuts by the U.S. Federal Reserve by the summer and expect a 10 bps cut by the European Central Bank.

Positioning Sun Life Granite Managed Portfolios

The broad selloff we’ve seen in U.S. equities has essentially erased the positive returns we saw over the past three months. Canadian equities have so far managed to hang on to a small gain over the same period, with one-year (total return) still exceeding 10%. On the other hand, we’ve seen a significant drop in interest rates, driving strong returns in high-quality bonds.

Given the unique nature of the virus, it’s challenging to model or predict what the ultimate impact of COVID-19 will be and how the market may react. In the context of our longer-term investment time horizon and fundamental approach to investing, we will continue to maintain a broadly diversified portfolio and to look for measured opportunities to seek returns and preserve capital.

Our strategy

Selling: We have trimmed some of our high-quality bond holdings, essentially taking profits following the strong rally we’ve seen in interest rates since mid-January. The current yield on 10-year Government of Canada bonds stands at 1.20%. At this level, we don’t see much potential to support income generation and longer-term capital preservation.

Buying: We have incrementally added to both cash and U.S. equities. For cash, yield has become relatively more attractive versus bonds, and we like the flexibility it provides to respond to shorter-term opportunities. For equities, while we expect fundamental economic data to be quite weak over the coming weeks, the recent correction has meaningfully reduced valuations.

For now, we prefer the U.S. over other countries and regions, given the relatively closed nature of its economy. One area of concern we’re watching in the U.S. is the somewhat crowded investor positioning, but we generally like the sector composition of the market and flexibility to provide monetary and fiscal policy support.

Holding off: Outside of the U.S. we believe a number of developed equity markets could be challenged over the near term, given their weaker economic position going into the current environment and less flexibility in terms of economic policy tools. We also continue to have a bias away from lower-quality, higher-yielding segments of the fixed income market.

The market’s reaction to past epidemics

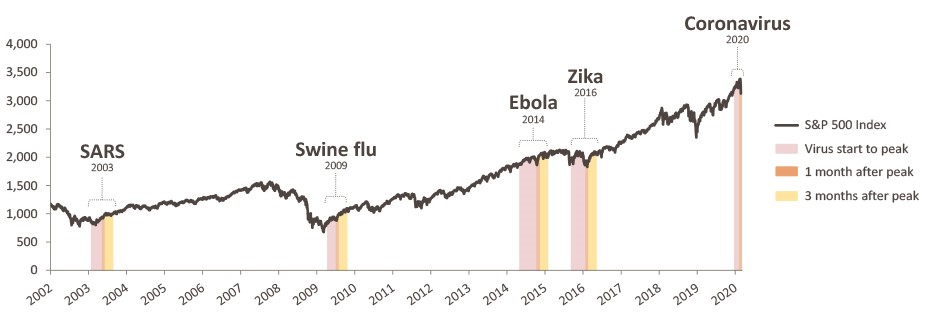

In past epidemics, the market sold off sharply but then regained its previous high after the outbreak peaked. (Chart below.)

If you’re concerned about market volatility, contact an Investment Planning Advisor* with CDSPI Advisory Services to learn how Granite Portfolios are designed to protect and grow capital in both the short and long term.

Sources: Centre for Disease Control; World Health Organization; Bloomberg. Data as of February 25, 2020.

This commentary contains information in summary form for your convenience, published by Sun Life Global Investments (Canada) Inc. Although this commentary has been prepared from sources believed to be reliable, Sun Life Global Investments (Canada) Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of Sun Life Global Investments (Canada) Inc. Please note, any future or forward looking statements contained in this commentary are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this commentary.

©Sun Life Global Investments (Canada) Inc., 2020. Sun Life Global Investments (Canada) Inc. is a member of the Sun Life Financial group of companies.

*Financial planning services are provided by licensed advisors at CDSPI Advisory Services Inc. Restrictions to advisory services may apply in certain jurisdictions.