Roller coasters provide plenty of thrills at an amusement park. Not so much when it comes to your investments.

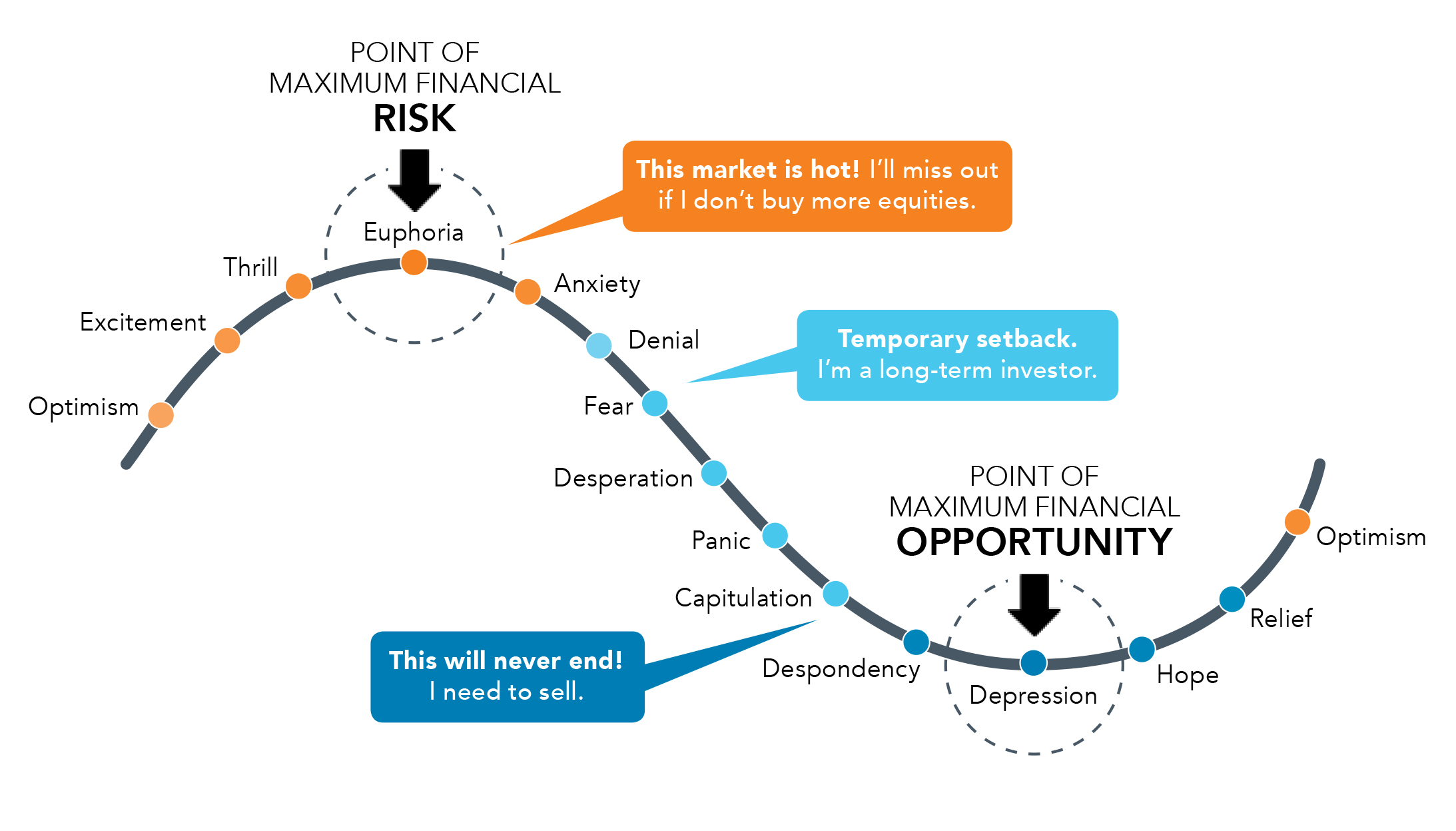

Stock markets have natural cycles of growth and decline. The chart below shows the full range of emotions that investors may experience through a complete market cycle. The danger is that if you give in to them you may commit the most notorious investment no-no: buying high and selling low.

Over time, markets continually experience periods of boom and bust. The good news is that the former far outweighs the latter, as you can see from these up and down time periods for the S&P 500 since 1934.1 Other indexes have shown similar patterns over the years:2

• Days: 53% up, 47% down.

• Months: 58% up, 42% down.

• Quarters: 63% up, 37% down.

• Years: 72% up, 28% down.

Volatility is a natural and unavoidable part of financial markets. You need to understand that, accept it, and think long-term. Wherever you are in your investment journey, it’s prudent to work with a Certified Financial Planner® (CFP®) professional who can create a roadmap for investment success, and help you stay disciplined when markets get scary.

Smooth your ride by contacting an Investment Planning Advisor* with CDSPI Advisory Services Inc.

1.800.561.9401 | investment@cdspi.com

1. U.S. Stock Bear Markets and Their Subsequent Recoveries, thebalance.com, 2018

2. Dow Jones – 100 Year Historical Chart, macrotrends.net, 2019; Bull and Bear Markets in Canadian Stocks, getsmarteraboutmoney.ca, 2018.

* Investment planning advice is provided by licensed advisors at CDSPI Advisory Services Inc.

Restrictions may apply to advisory services in certain jurisdictions.