Sadiq S. Adatia, Chief Investment Officer at Sun Life Global Investments comments on current market conditions, the likelihood of a recession sparked by the coronavirus, and what investors can do to position themselves during market corrections.

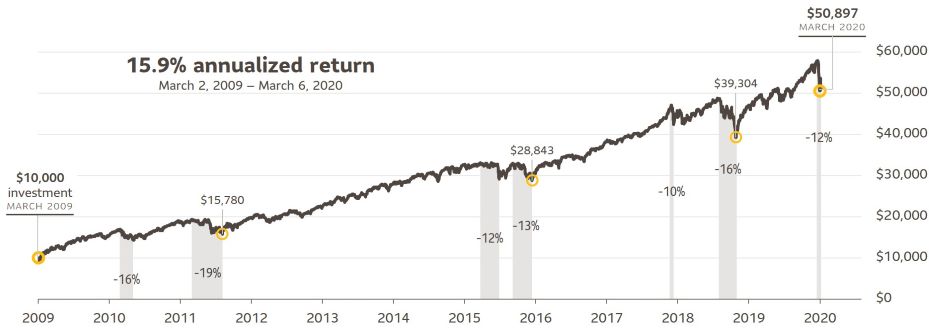

After hitting bottom on March 9, 2009 in the depth of the financial crisis, the bellwether S&P 500 turned around and launched into one of the greatest bull runs in history, posting a 448% gain to Mar. 6, 2020. It wasn’t straight up – along the way there have been seven nerve-fraying corrections with the market falling by more than 10% each time.

The latest market correction was triggered by the emergence of the Coronavirus in China late in December, 2019. It quickly spread worldwide and the markets entered a correction (defined as a 10% to 20% drop) as they priced in a global economic slowdown.

Perhaps because the latest correction was sudden and deep, the noise around it seemed particularly loud and gloomy. But if history repeats, this latest correction (which is still playing out) may turn out to be another dip in an ongoing bull market.

Unfortunately, investors, whipsawed by the extreme volatility corrections cause, often sell and head to the sidelines. That’s why it’s important to realize that despite all the drama, corrections are actually common and can be brief.

In fact, between 1945 and the current selloff, the S&P 500 has gone through 26 corrections, with the index falling by around 13% on average over a four-month period. And it generally took four months for the S&P 500 to move from the low it reached in the correction back to its previous peak.1

Market corrections in the great bull market

The six previous market corrections in the current bull market have followed the same pattern, with the market falling, before moving on to new highs. Will the current coronavirus-related correction play out the same way? Only time will tell, but market history suggests it may.

Correction |

Drop |

Length (Months) |

Return to previous high (Months) |

April 23, 2010 to July 2, 2010 |

-16% |

2 |

4 |

April 29, 2011 to Oct. 3, 2011 |

-19% |

5 |

5 |

May 21, 2015 to Aug. 25, 2015 |

-12% |

3 |

3 |

Nov. 3, 2015 to Feb. 11, 2016 |

-13% |

3 |

3 |

Jan. 28, 2018 to Feb. 8, 2018 |

-10% |

0.5 |

5 |

Sept. 30, 2018 to Dec. 24, 2018 |

-16% |

3 |

6 |

Feb. 12, 2020 (as of Mar. 6, 2020) |

-12% |

? |

? |

Source: Sun Life Global Investments.

From lows to new market highs

While this latest correction is related to a worldwide epidemic, historically corrections have shaken excesses out of the market, before it ultimately moves on to another high. This is generally how markets have performed in the post-Second World War era, with rallies following a correction lasting almost 500 trading days on average, moving from the market bottom through the previous high to a new market peak.2

When the bears arrive

Corrections can definitely turn into bear markets, defined as a market loss greater than 20%. The S&P 500 has breached this 20% barrier 11 times since 1945, with the pullback lasting on average 13 months with an average loss of 30%.4 By comparison, the last bear market, triggered by the 2008 financial crisis, lasted for almost 17 months with the S&P 500 losing over 50% of its value.

Could the current correction turn into a bear market? It’s always a possibility, but historically severe downturns usually occur when the economy is either near, or in recession, and corporate earnings fall. At this point, the opposite seems to be true – earnings were holding up and the global economy was growing – albeit hindered by the U.S./China tradewar and now the coronavirus.

Comparing bear markets and corrections

Since 1945: Average performance, length of downturn and recovery

Drop |

Length (Months) |

Return to previous high (Months) |

|

Bear markets (11) |

-30% |

13 |

22 |

Corrections (26) |

-13% |

4 |

4 |

Source: Goldman Sachs Global Investment Research

Our view on the current market correction

CDSPI Granite Portfolios, managed by Sun Life Global Investments, are designed to help you achieve financial security with less worry in all market conditions. The portfolio management team has responded to the current environment by making the changes outlined below.

Even though, this correction was triggered by the coronavirus, our approach at times like this is to always first look to protect capital but secondly look for longer term opportunities. And, like those before it, the volatility associated with this correction, could open the door to creating long-term value.

We have trimmed some of our high-quality bond holdings, essentially taking profits following the strong rally we’ve seen since mid-January. The current yield on 10-year Government of Canada bonds is at 0.72% — a level that we don’t think can support income generation or longer-term capital preservation.

We believe the U.S. economy is still the world’s strongest and we have incrementally added U.S. equities and cash. Cash yield has become relatively more attractive versus bonds. And we like the flexibility it provides to respond to shorter-term opportunities. For equities, while we expect fundamental economic data to be quite weak in the coming weeks, the recent correction has meaningfully reduced valuations. The question will be whether companies will have permanent impaired earnings or will the earnings just be delayed for a quarter or two?

As noted, for now, we prefer the U.S. over other countries and regions, given the relatively closed nature of its economy. One area of concern we’re watching in the U.S. is the somewhat crowded investor positioning. But we generally like the sector composition of the market, as well as the flexibility of the government and U.S. Federal Reserve to provide monetary and fiscal policy support.

While we are more positive on the U.S., we believe a number of developed equity markets could be challenged over the near term, given their weaker economic position going into the current environment. They also have less flexibility in terms of economic policy tools. And we continue to have a bias away from lower-quality, higher-yielding segments of the fixed income market.

We have also taken advantage of our option strategy where we have been able to find great opportunities to generate premium increase due to the heightened volatility in the markets.

Ultimately, our decision to invest in the midst of a correction underscores this fact: If you’re in the market, you will likely experience a correction. If you do, as we’ve shown here, often the best strategy is to simply stick to your long-term investment goals.

If you’re concerned about market volatility, or would like to discuss your long-term investment goals, book a meeting with an Investment Planning Advisor with CDSPI Advisory Services Inc.*

This commentary contains information in summary form for your convenience, published by Sun Life Global Investments (Canada) Inc. Although this commentary has been prepared from sources believed to be reliable, Sun Life Global Investments (Canada) Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of Sun Life Global Investments (Canada) Inc. Please note, any future or forward looking statements contained in this commentary are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this commentary.

©Sun Life Global Investments (Canada) Inc., 2020. Sun Life Global Investments (Canada) Inc. is a member of the Sun Life Financial group of companies.

*Insurance and investment planning advice is provided by licensed advisors at CDSPI Advisory Services Inc. Restrictions may apply in certain jurisdictions.