By Shan Janmohamed, BA, CFP®, RRC®, Investment Planning Advisor, CDSPI Advisory Services Inc.

sjanmohamed@cdspi.com | 1.800.561.9401, ext. 6826

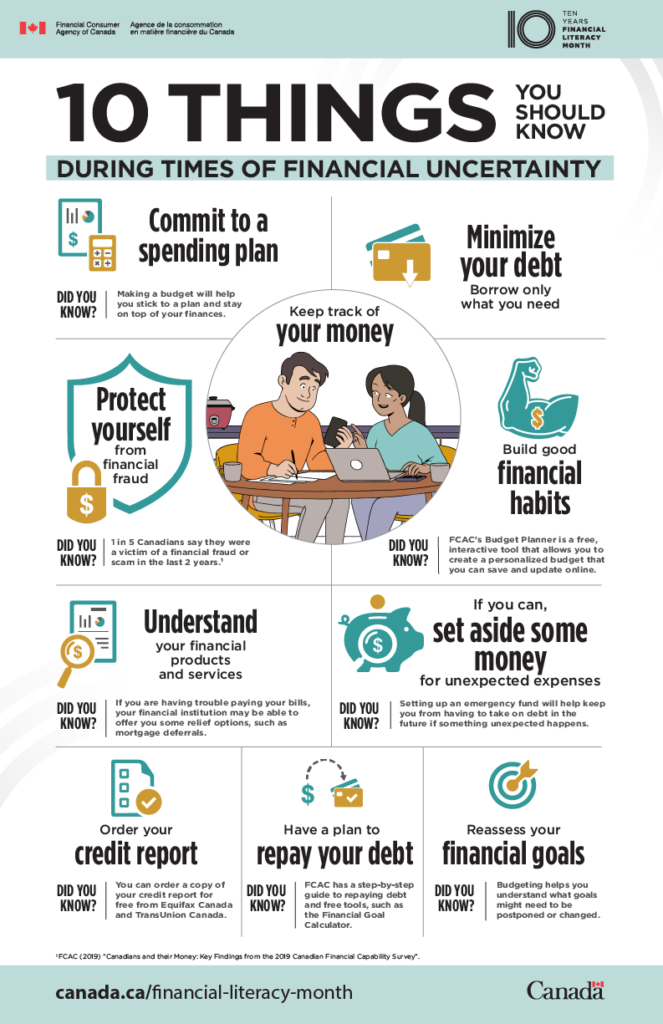

The initial onset of the COVID-19 pandemic and subsequent lockdown were both a reminder of life’s unpredictability and an extreme example of it. With Financial Literacy Month among us, it’s the perfect time to discuss the importance of being adaptable and resourceful in order to stay ahead.

Here are some personal finance and practice tips to help you navigate these uncertain times.

Check the pulse of your surroundings:

We have all become accustomed to checking the latest COVID-19 statistics and comparing cases as specific as by neighbourhood with broader nationwide and global numbers. By managing or working at an active practice, you also have access to firsthand data.

- Check in with your patients. They live, work and shop in the neighbourhoods you operate in. Consider asking how they feel about the situation, what is going on at their workplaces, and their children’s schools. Besides building your relationships with them by showing empathy, it is also a great source of information and a potential warning sign of disruptions in your area.

- Check in with your staff regularly. Find out how production is going and ask how they are doing and how they are managing day-to-day. It will not only serve as an additional source of data, but it will also strengthen your team. Remind any staff who are-struggling or looking for resources that they have access to CDSPI’s no-cost Members’ Assistance Program (MAP).1

Take inventory:

This year has provided a lesson in supply chain management. The old theory was to run at maximum efficiency, but the pandemic has shown us that having a cushion is important.

- Speak with your suppliers to find out how they are doing. The current restrictions have taught us to value all connections more. But also, learning about their stresses and the possible kinks in their supply channels will help you to determine if placing an extra order is warranted. It is especially challenging to balance having adequate cash on hand with sufficient inventory these days, so the more information you have to make these decisions, the better.

Review your financial plan:

Although no one’s personal or business plans for this year are where they were expected to be, there is a lot of value in re-evaluating and identifying where you may be falling short.

- Understand the discrepancy between where you are and where you thought you would be. This will help you determine the adjustments you need to make. And with many months of the pandemic now behind us, you now have new information to help you make decisions for 2021 – a year that will also likely be met with uncertainty.

- Create a financial plan or revise your existing one. Longer term, developing and staying on top of your plan will help you to find your way back to where you need to be as the current challenges recede – and they will.

Remember, planning can help manage the unpredictable:

While this year has been an extreme example of it, CDSPI has always been there to help you plan for the unpredictable. The right insurance coverage can protect you from many dangers, including disability, unemployment, malpractice, practice closure, and more.

- Make sure you’re adequately covered. Our licensed insurance advisors have always worked to build a buffer around clients and help protect your financial plans from the dangers we know are out there but can’t predict when, or how they will affect us.

Avoid recency bias:

- Remind yourself that these are extraordinary times. As we move into 2021, we will have the day-to-day concerns of COVID-19, and our recent memories of pandemic life. Psychological studies show that we overweight recent experience and we also overweight negative, stressful ones. This means we are heading into the darker days of winter with a lot of mental baggage. Now, more than ever, it is important to take a long view to see our way through this.

- Contact the CDSPI Members’ Assistance Program (MAP). If you need support MAP is available at no cost to you, 24 hours a day, 7 days a week. You can receive short-term counselling for numerous issues, as well as relevant resources to help you cope.

The decisions you make now will help to manage this unpredictable environment that we’re all in. Stay informed and get sound advice from an Investment Planning Advisor2 from CDSPI.

Are you prepared financially for the road ahead? Let’s discuss.

Source: https://www.canada.ca/en/financial-consumer-agency/campaigns/financial-literacy-month.html

1 Shepell is the largest Canadian-based Employee and Family Assistance provider in the country and the provider of CDSPI’s Members’ Assistance Program (MAP). In addition to their health and wellness services, Shepell offers many helpful articles for small business owners at workhealthlife.com. We encourage you to visit the website for more information. Available services vary by region. Use of MAP services is completely confidential within the limits of the law.

2 Restrictions may apply to advisory services in certain jurisdictions. Financial planning and advisory services are provided by licensed advisors at CDSPI Advisory Services Inc.