Have you ever spent the weekend indulging in your favourite comfort foods – juicy steak, aged cheese, salty potato chips and maybe some wine – only to crave a piece of fruit or some green leafy vegetables after a few days? It’s your body’s way of telling you that you need to restore some equilibrium to your diet. The reason is simple: we all need some balance in our lives and this basic principle is key when it comes to your investment portfolio.

Every savvy investor should have a target asset allocation of stocks, bonds and cash in their portfolio that matches up with their risk tolerance and investment goals. When a portfolio is initially set up, balance is achieved. But because asset classes perform differently over time, a portfolio’s asset allocation can get out of balance as stocks and bonds perform well or poorly. Rebalancing brings a portfolio’s original asset allocation back to where it was when you first set it up.

How rebalancing works

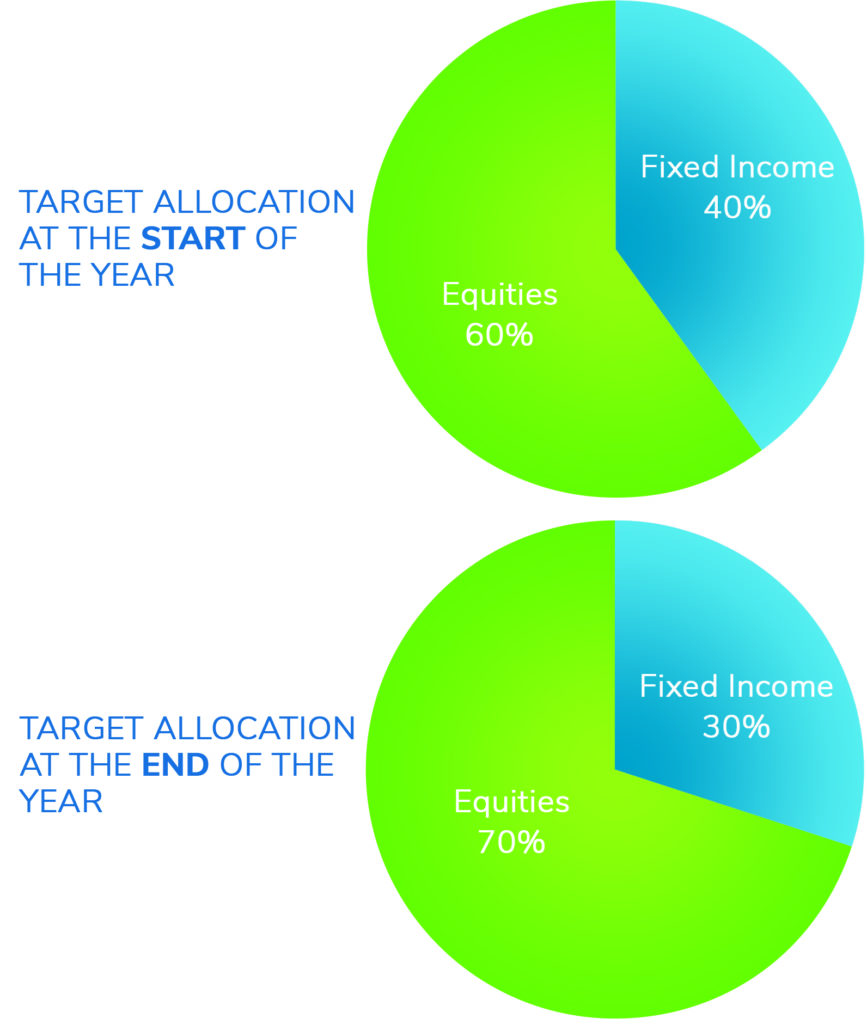

Say your portfolio is made up of 60% stocks and 40% bonds. If stock prices rise, your allocation to stocks might increase to 70%, and bonds drop to 30%.

To get back to your target mix, you will need to sell 10% of the value of your stocks and increase the value of your bond holdings by 10% in order to achieve balance.

The benefits of rebalancing

Rebalancing allows you to:

- Limit your exposure to risk. By rebalancing, you can maintain a level of risk that’s suitable for you, your timeline and your goals.

- Sell high and buy low. Rebalancing allows you to take profits from investments that have done well and redirect them to a class that might be undervalued.

- Stay disciplined. It can be tempting to hang on to a stock that’s doing well. Regularly rebalancing keeps you focused on your financial plan.

When to rebalance

You can rebalance your portfolio based on time or a threshold.

Rebalancing based on time prompts you to rebalance your portfolio regularly—typically every year—regardless of how much or how little your asset allocation has changed. You may want to rebalance more often if you are concerned about risk.

It’s also smart to set a minimum threshold such as 5% or 10% – when your portfolio drifts past this threshold, it’s time to rebalance.

That said, the parameters around frequency and threshold are ultimately based on a discussion between you and your financial advisor.

CDSPI can help!

An Investment Planning Advisor can help you determine the right target asset allocation based on your life circumstances, timeline and tolerance for risk. Your advisor will review your portfolio regularly with you to maintain balance that’s in line with your financial goals.

CDSPI offers solutions that automatically keep you in balance. We determine your risk level—from conservative to aggressive—and the portfolio managers keep it on target.

Keeping your investments in balance is critical to financial success. We invite you to contact us for a complimentary review to help you achieve balance.

1.800.561.9401 | investment@cdspi.com